Affected by the global political and economic turmoil, shrinking consumer psychology and continued tight supply of raw materials, the global electric vehicle market still maintained its growth momentum for 27 consecutive months. Of course, the installed volume of power batteries also continued to climb.

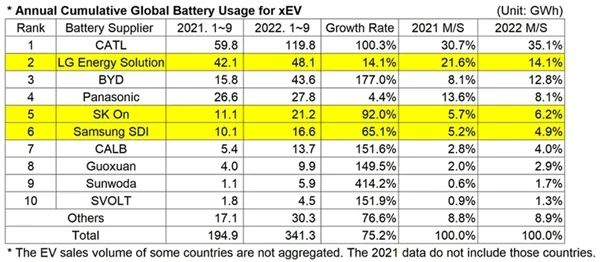

On November 1, SNE Research, a global information agency, released the global EV battery installation data from January to September 2022. The data shows that from January to September 2022, the global EV battery installation totaled 341.3 GWh, up 75.2% year-on-year.

SNE Research believes that the growth rate in the China region was particularly impressive, with Chinese companies dominating the market growth, as major power battery markets such as China and the U.S. both grew.

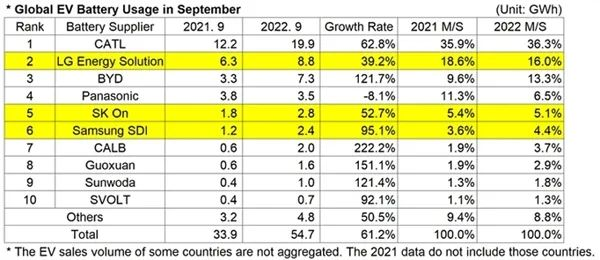

For the single month of September, the total global electric vehicle battery installation was 54.7 GWh, up 61.2% year-over-year. Chinese company Ningde Times ranked first in the world with 19.9 GWh of installed capacity. Previously, in August, BYD's battery installation had overtaken South Korea's LG New Energy to rank second in the world, but in September, LG New Energy's battery installation was 8.8 GWh, returning to second, and BYD's power battery installation was 7.3 GWh, receding to third.

From January to September 2022, Ningde Times and LG New Energy continued to rank first and second in the global power battery installation volume. Among them, Ningde Times' installed power battery volume was 119.8 GWh, up 100.3% year-on-year, with a global market share of 35.1%, up 4.4 percentage points from 30.7% in the same period last year.

LG New Energy ranked second with 48.1 GWh installed, up 14.1% year-on-year, 4.5 GWh more than BYD in third place, and its global market share was 14.1%. BYD was third with 43.6 GWh installed, up 177.0% year-on-year, and its market share grew rapidly from 8.1% last year to 12.8%.

Japan's Panasonic ranked fourth with 27.8 GWh of power batteries installed, a year-over-year growth rate of 4.4%, and was the only company in the top 10 list with a single-digit growth rate. The company's market share fell sharply from 13.6% in the same period last year to 8.1% this year. Its installed volume in September was even negative year-on-year, with a single-month installed volume of only 3.5 GWh, down 8.1% year-on-year, and it is also the only company in the top 10 list with negative growth in installed volume in a single month.

From January to September, the ranking order of the fifth to tenth place of global power battery installation volume is unchanged from last month. SK On and Samsung SDI of South Korea continue to be the fifth and sixth, and then they are all Chinese companies, namely Sinova, Guoxuan High Tech, Xin Wanda and Honeycomb Energy. Xinwanda's installed volume growth is still very rapid, up 414.2% to 4.5 GWh from 1.8 GWh in the same period last year.

In terms of overall market share, the market share of Chinese battery companies reached about 57.8% in the first nine months of this year, up 12.7 percentage points from 45.1% in the same period last year and down slightly by 0.3 percentage points sequentially, while the market share of Korean companies was about 25.2%, down 7.3 percentage points from 32.5% in the same period last year and up 0.2 percentage points sequentially.

According to SNE Research's analysis, the growth momentum of the three Korean battery companies was mainly driven by the sales of electric vehicle models equipped with each company's batteries. SK-On further expanded its growth momentum, influenced by the continued increase in sales of models such as the Hyundai ionic 5 and Kia EV6, and with the new launch of the Hyundai ionic 6. Samsung SDI's growth was driven by continued increased sales of Audi E-Tron, BMW iX, BMW i4, Fiat 500, etc. LG New Energy benefited from the high popularity of Tesla's Model 3 and Model Y as well as favorable sales of VW ID.4 and Ford Mustang Mach-E.

As a manufacturer with nearly two decades of experience in the lithium battery industry, SES Power is very concerned about the safety of lithium battery systems while achieving the best cost performance. For example, we use square aluminum-cased lithium iron phosphate batteries with good safety performance to make our products, such as lead-acid alternatives (12V100Ah, 12V200Ah, 24V100Ah, etc.). High current (2000A) starter lithium battery, UPS high voltage lithium battery system (up to 860V), 3Kw~20Kw off-grid, grid-connected, islanded lithium battery energy storage system, wall-mounted form of home energy storage system 48V100Ah, 48V200Ah, stacked energy storage system (single unit of 51.2V100Ah, supporting up to 15 stacks), etc.

If you have any questions about lithium batteries, you are welcome to contact us.