American lithium battery: the rise and fall of A123, only a sigh is left in the end

A123 was the king of lithium-ion batteries in the United States more than ten years ago, and the leader in the world's lithium battery industry. The performance of A123's lithium-ion battery is very powerful, and the quality is also the world's top. It also grew up on the eve of the explosion of electric vehicles and energy storage systems. However, the American A123 no longer exists, only the Chinese A123, what happened?

SES Power has more than 20 years of experience in the lithium battery industry, and its main business is customized lithium-ion battery packs, but we are very familiar with A123 and have applied A123 cells to start-up batteries at a very early stage, such as using high-performance rate lithium Battery A123 12V30Ah, 12V50Ah car starting battery (maximum peak current can reach 1500A). Until today, SES Power has not found a better battery supplier than A123, although we have high-end customized lithium battery products, such as 12V100Ah, 12V200Ah, 24V100Ah, 24V200Ah, 36V100Ah, 48V50Ah using square aluminum-shell lithium iron phosphate batteries, 48V100Ah, etc. Even customers who are very picky about performance, if SES Power tells them that the battery pack uses A123 products, they have almost no objection to the performance, just care about the price.

A123 production line

Here's a detailed explanation of why the venerable A123 is gone by SES Power.

A: What made the US government push the US lithium battery industry and star enterprise A123

From 2008 to the present, looking at the campaign slogans of previous US presidents, they actually said the same thing - the return of manufacturing, stimulate economic recovery, and provide more local jobs.

Biden in 2020: "Building a Better Future!"

Trump in 2016: "Make America Great Again!"

Obama in 2012: "Go Forward!"

Obama in 2008: "Yes, we can!"

These slogans paint a freehand picture of a bright future for the empire, but the reality is very cruel. The U.S. always seems to be able to smash a good hand at times—like the lithium-ion battery industry.

In August 2021, the Biden administration proposed a 2030 target by which half of all new cars sold in the United States will be new energy vehicles. He also proposed to invest 174 billion US dollars in power vehicles and related industrial chains. Similar policies were promoted by Obama 12 years ago when Biden was the vice president of the United States.

In Obama's vision, lithium batteries are a sunrise industry that can quickly stimulate the US economy after the subprime mortgage crisis. If manufacturing plants are relocated to the United States, the unemployment rate in the United States will drop significantly. What's more, in the field of lithium batteries, the United States already has a leading advantage.

In 1999, Zeng Yuqun, the founder of CATL, purchased the patent of polymer lithium battery from Bell Labs in the United States. Among the three winners of the Nobel Prize in Chemistry in 2019 for the invention of lithium batteries, two also came from research institutions and universities in the United States.

With this "good hand", after the subprime mortgage crisis, the Obama administration bet on A123, a domestic lithium battery company, and pushed more than 10% of new energy subsidies to A123. Because the U.S. government hopes to use A123 to put the Stars and Stripes in the lithium battery market occupied by China, Japan and South Korea.

However, in October 2012, less than four years after being supported by the Obama administration, A123 went bankrupt.

B: The brilliance and intoxication of star enterprise A123

Ask Michigan native Annette Herrera to reflect on the darkest moments in her life, and she'll tell you two: 2008 and 2012.

4 years, a lost dream. It coincides with the rise and fall of the lithium battery industry in the United States.

When the subprime mortgage crisis broke out in 2008, the U.S. unemployment rate hit a 16-year high of 7.2%. 2.6 million jobs disappeared. Annette, 50, was suddenly laid off and has been homeless for two and a half years. But it was this crisis that made fate favor Annette for a short time - she bet on the wind of the times.

At that time, Obama called for the return of manufacturing to the United States, and showed a trump card - stimulating the economy with the new energy industry and creating jobs. The United States kicked off the prelude to the de-globalization of manufacturing. The main business of A123, a star enterprise of lithium batteries in the United States, also changed its course this year: from consumer lithium batteries for electric conversion tools to power batteries. Right on the appetite of the Obama administration.

A123 was founded in early 2001 by Jiang Yeming, a professor of materials science and engineering at MIT. Jiang Yeming has a number of unpublished research results, and A123 is his channel to transform technology into products. One of them is the fast charging technology of "charging for 5 minutes and talking for two hours". As early as 2009, A123 developed a lithium battery that can charge 90% in 5 minutes, and its life is 10 times longer than that of ordinary batteries.

The US government is willing to believe that A123 will become an American company leading the global battery industry. Since 2009, the Obama administration has provided US$2.4 billion in government subsidies to support the new energy vehicle industry, of which US$250 million has flowed to A123. However, the U.S. government requires that A123 need to move the production line to the country, adding 1,000 jobs within three years from 2009.

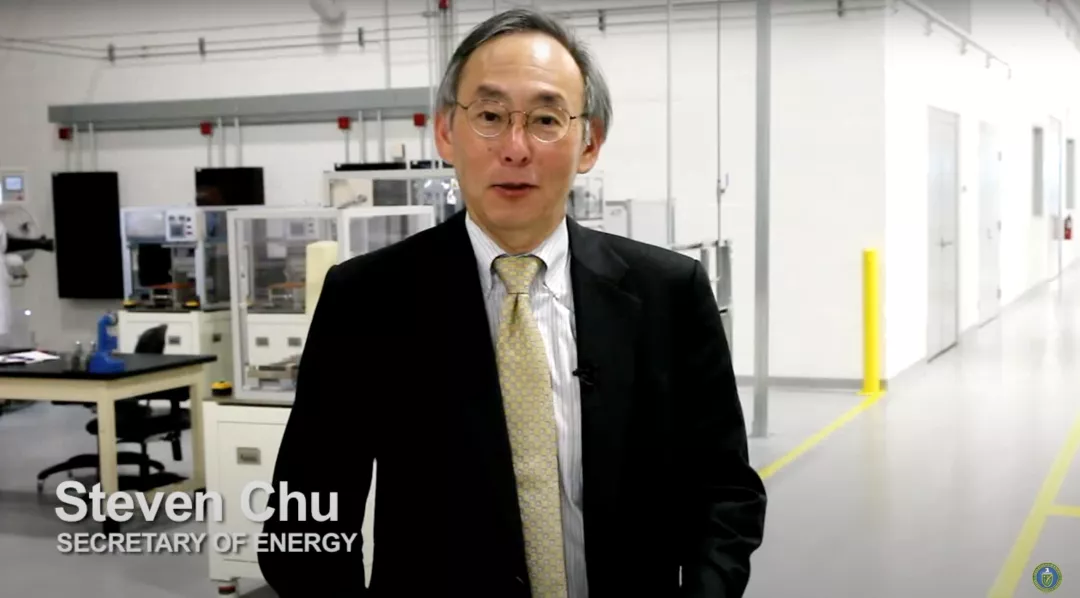

The then US Secretary of Energy Steven Chu appeared at the A123 factory

Annette is benefiting from this. She became one of the first 300 workers hired at A123's first U.S. factory, Romulus, Detroit, as a mechanic on an automated production line. There, she witnessed the brilliant node of a star enterprise - a phone call from the White House at the opening ceremony of the factory.

“This (the A123 Romulus plant opening) represents the birth of a whole new industry in the United States (power batteries) that will be at the heart of the next generation of vehicles. The work you are doing now will help boost the American economy for many years to come. " Obama said.

Optimism and confidence are amplified by the clack of champagne glasses. A Michigan official said that the new energy industry will bring 36,000 jobs to the United States. "There is ample evidence that manufacturing is returning to the U.S., which will be the new home of future electric vehicles."

In this American lithium battery dream party, Annette ushered in the highlights of her life. On September 20, 2011, A123 celebrated the entry of its 1,000th employee, completing the small job target set by the US government.

"It's a good start and we're moving into the future," Annette said to the camera.

The media loves this kind of stories about middle-aged people re-employment - take a look, Annette has been out of work for more than 2 years and has no experience in the lithium battery industry, but riding the huge wave of the development of the lithium battery industry in the United States, she still shines for the society and the family fever.

What Annette didn't expect was that by the end of 2011, just two months after the interview, A123 had laid off 125 people. She is unemployed again. A123 also ended up in bankruptcy.

The death knell sounded in October 2012.

C: The Great Leap Forward that does not meet the needs of the market

The end of A123 has long been doomed, because it has become a great leap forward in production capacity that does not conform to the laws of the market in the context of de-globalization in the United States.

Originally, A123 was a light-asset enterprise, focusing on the research and development of lithium iron phosphate battery technology. Like most American companies, it stands at the high value-added ends of the smile curve and anchors high profits. The low value-added part of the lithium battery production process is outsourced to factories in China, Japan and South Korea through the global division of labor.

Before the production line was relocated to the United States, the anode material of A123 was provided by Changzhou, China, the cathode of lithium battery was produced in South Korea, and the assembly process was arranged in Shanghai, China.

The rules of the game for globalization are formulated by developed countries such as the United States in order to maximize their own interests. However, profit-seeking companies have relocated their production lines. While increasing profits, they have also buried hidden dangers of industrial hollowing in the United States—the rust belt economy has declined, and the impoverishment of middle and lower-level blue-collar workers has intensified.

Robert Putnam, a professor of public policy at the Harvard Kennedy School of Government, pointed out in "Our Children: The American Dream in Crisis" that today the United States cannot find a job by itself, compared to the 1950s, when the American Dream prevailed. realize your dreams and values.

Americans, who can't find jobs, blame globalization for everything. Under this sentiment, the United States eventually turned from an advocate of globalization to a promoter of anti-globalization. However, simply thinking that moving the production line to the United States will increase employment and alleviate domestic conflicts in the United States is just the wishful thinking of the Obama administration. A123 returns to the United States, where the industry is hollowed out, and the difficulties it faces are:

1. Need to invest in production line

In the four years since 2008, A123 has invested more than 300 million US dollars. The asset-light model has changed into a capital-heavy model.

2. Recruit local staff

The American "Technology Review" magazine reported that in 2010, the hourly wage of American workers was $22.3, while the hourly wage of Chinese workers was only $2, less than 1/10 of the former.

Michigan Factory for A123

If you know these two points, you won't be surprised why A123 produces a ridiculously expensive lithium battery product: A123 lithium iron phosphate battery costs as much as $1,000 to $1,500 per kWh, while Panasonic's ternary lithium battery, The cost is only $320-420.

Generally speaking, ternary lithium batteries contain scarce metals cobalt and nickel, and the manufacturing cost is often higher than that of lithium iron phosphate. At the moment when the production line returned to the United States, A123 could not avoid the fate of high costs, which was a congenital defect. However, A123 can theoretically reduce costs through mass production. This is also the great leap forward in lithium battery production capacity that the U.S. government is willing to see.

It can be corroborated that the requirements for A123 to obtain government subsidies are oriented by the number of jobs and production capacity. But the U.S. government has overestimated the market demand for lithium batteries - Americans are not very accepting of new energy vehicles.

Until 2020, the penetration rate of new energy vehicles in the United States is less than 2.2%. "Tesla's audience is not ordinary consumers, but people with Porsches in their garages. If Tesla can enter the mass market, they are equivalent to handing over their heads to users." A senior researcher at the International Council on Clean Transportation once Publicly express pessimistic predictions about new energy vehicles.

Insufficient market demand makes it difficult for A123 to have bargaining power. The continuous expansion of production capacity has caused the price of lithium batteries to continue to fall. Finally, a tragic scene happened.

A123 lithium battery

Since 2009, A123's operating income has increased by 30%-40% every year, but the amount of performance loss is also increasing year by year. In 2011, A123 had a net loss of 97 million US dollars, and in the first half of 2012, the loss amounted to 83 million US dollars, close to the previous year's value. The more and more batteries are produced, the more they sell and the more they lose money.

In fact, in 2011, A123 lost $0.57 for every $1 of lithium battery sold. At that time, some analysts estimated that the A123 could barely maintain its balance of payments by expanding its production capacity by a dozen times. But constantly burning money, product sales can not return blood. The A123 walks into a dead end. Until a debt completely overwhelmed it.

In 2012, an electric car produced by Fisker, a major customer of A123, suddenly stalled during inspection. The ultimate reason is that the lithium battery produced by A123 has technical defects. A123 recalled the related battery pack and promised to pay $55 million in damages.

Just a few lines of words in the news briefing are an important node in the collapse of the lithium battery industry in the United States. A123 not only lost a major customer of Fisker, but also declared bankruptcy due to inability to repay its debts. The battery failure also dragged down Fisker's performance, which also went bankrupt in 2013.

The malfunctioning electric car was called Karma (Cause and Effect). Tracing the story of the decline of A123, it is the American empire that prioritizes its own interests, and the anti-globalization production of lithium batteries advocated by it and the incompatibility brought by it - the high cost of domestic manufacturing in the United States and the lack of market demand momentum.

It does not conform to the laws of the market, but the U.S. government has promoted a great leap in lithium battery production capacity, and enterprises have fallen into the abyss of circulation. The production, recruitment and expansion of lithium battery companies are talking about the same thing: burning money, burning money or burning money.

The star company A123 is not the only case in the US lithium battery death list. Solyndra, which received US$535 million in government-guaranteed loans, and Ener 1, which received US$118.5 million in government aid, were also withdrawn from the market at about the same time.

The ultimate fate of A123 is to be acquired by Chinese company Wanxiang. At the end of 2013, when the acquisition came to fruition, some American media used the headline "The American lithium battery industry is dead!"

The end of an era.

D: Technological breakthroughs are exhausted, and policies are changing rapidly

The distance between hope and reality is a rain.

Obama tried to lead a great leap forward in the lithium battery industry in the United States. After all, there was a lot of thunder and little rain.

Once, the U.S. government held a good card for technology first-the United States was one of the first countries to study the principle and basic technology of lithium batteries. The advantage of American manufacturing lies in technology research and development, but in the lithium battery industry, technological breakthroughs are weak. Technology is mainly divided into academic and industrial ends.

D1 academic side: no major breakthroughs in technology and low quality papers

From 2008 to January 2017, during the Obama administration, global lithium battery-related papers increased significantly. According to Web of Science data, there were more than 10,000 SCI papers related to lithium batteries in 2016, more than the sum of the previous ten years.

The number of blowout papers does not mean that new technologies are blooming. On the contrary, 70% of American papers focus on the two original technical fields of lithium iron phosphate and nano-scale lithium batteries, and there is still no progress. This is the phenomenon of low-quality papers in academia.

In contrast, at this time, no major breakthroughs have occurred in the basic research of global lithium batteries. Common materials for lithium batteries such as ternary lithium, lithium iron phosphate, and lithium titanate are academic achievements at the end of the last century.

D2 industry side: the industry has been hollow for many years, with little experience accumulation

Japan's Sony mass-produced its first lithium battery in 1991, and by 2008 had nearly 20 years of production experience. China and South Korea produced lithium batteries around 2000. In the mid-to-low-end market, workers accumulated experience in a large number of repeated production, laying the foundation for the transition to high-end manufacturing.

Compared with the hollowing out of the industry for many years, the technical accumulation of the lithium battery industry in the United States has begun to become a shortcoming. Since then, many lithium battery companies have withdrawn, making the accumulation of workers' experience more unsustainable. The lithium battery industry is not only a technology-intensive industry, but also labor-intensive and capital-intensive. It is the market that mediates between labor and capital.

Clear this logic, you will find that the end of A123 implies that the US lithium battery is not only technically difficult to form strong technical barriers, but also unable to gain advantages from market competition.

D3: Policies that change from time to time

China, Japan and South Korea can win the global lithium battery competition, relying on their respective advantages in labor costs, industrial systems, technical talents and capital accumulation. If the U.S. government can recognize this at this time, stimulate the new energy vehicle industry from a market perspective, and increase the demand for power batteries, perhaps there is still room for American lithium batteries to recover. But the US lithium battery has encountered an insurmountable difficulty - a policy that has been changed day by day.

E: The entanglement of interests of all parties

After all, in addition to the companies, employees, and users who appear on the market stage, there is another undercurrent of mixed interests behind the scenes. Let's take a look at some history:

Arizona. The afterglow on the giant cactus dissipated, and the dark night restored the cruel image of the desert - this is the cemetery of the new energy vehicle EV1.

GM EV1

EV1, the first electric car in the United States to attract public attention, was once the car of Hollywood stars such as Tom Hanks and Mel Gibson. Today, it is difficult for you to see the short-lived revival of new energy vehicles in the United States around the millennium in the fragmented car body.

The tuyere started in December 1996, when General Motors of the United States launched its first electric vehicle, the EV1. With the iteration of the power battery, the EV1 has a range of 135 kilometers, which can meet the needs of traveling between cities.

EV1 adopts a rental model, with a monthly rent of between 480-640 US dollars. Compared with gasoline vehicles and hydrogen vehicles, the use cost is higher. In addition, it has no carbon emissions, and has won a group of American environmentalists.

In 2002, six years after its birth, the EV1 was discontinued. The general selection will recall EV1 centrally and destroy it uniformly. The documentary "Who Killed Electric Vehicles" restores such a picture: some EV1 enthusiasts and GM staff are divided into opposing camps, trying to make their EV1 avoid the fate of damage. Some even traveled to the Arizona desert and stole their car...

Why can't GM accommodate EV1? From a business model point of view, EV1 sells on a rental basis, which makes GM feel the pressure of debt. But the aforementioned documentary gives an answer from another angle-EV1 touches the interests of oil giants and traditional automobiles.

U.S. oil majors Exxon Mobil, Chevron-Texaco and Conoco-Phillips are concerned that once electric vehicles are rolled out in the U.S., they will cut more than 100 billion gallons of gasoline annually. They joined forces with traditional American car companies to suppress.

Even oil giants bought electric motor companies upstream of electric vehicles and set restrictions on the supply chain to prevent the rise of new energy vehicles. At that time, the spokesperson of the traditional energy and automobile consortium was US President George W. Bush, who took office from 2001 to 2009.

ExxonMobil Louisiana Plant

Why did Bush Jr.'s new energy policy shift to the development of hydrogen energy and hydrogen fuel cells with relatively weak technological foundations when the electric vehicles in the United States first started to take off--isn't it to make time difference and allow oil companies to continue to make profits?

In the United States, behind the rise and fall of an industry, it seems that there are always several forces from different camps playing against each other. Looking back at the attitude of the last four US presidents on new energy policy, the plot has reversed and reversed, but it will never escape the new president's policy of overthrowing the former president, and the new president will resume the policy model that was denied by the former president.

Teams in Congress representing traditional energy interests have tried to thwart Obama's policies. In 2012, Obama proposed US$650 million for research on batteries and new energy vehicles, but the US Congress approved US$330 million, cutting the budget in half.

After Obama, as soon as Trump took office, he canceled the subsidy policies for lithium batteries and electric vehicles. American new energy vehicles once again missed a critical moment of development, and local lithium battery companies have no improvement.

F: do not advance or retreat

When Biden took the old path of Obama, the story seemed to regress to a delicate cycle - the US lithium battery industry would fall back if it did not advance, and it still failed to break into the market where China, Japan and South Korea defended the base.

Currently, the United States is facing:

Near-term concern - insufficient local power battery capacity

Foresight - the upstream and downstream of the industrial chain have not yet opened up.

In March 2021, the US government released the "Infrastructure Plan", which proposed to invest 174 billion US dollars to support the development of the US electric vehicle market, involving improving the domestic industrial chain, sales discounts and tax incentives.

The plan calls for 500,000 electric charging stations, school buses and federal fleets to be built by 2030. However, after the bankruptcy of A123, it is difficult for the domestic lithium battery industry to keep up with the development of electric vehicles.

The "U.S. Lithium Battery Blueprint 2021-2030" released by the American Advanced Battery Alliance has a pessimistic prediction that even by 2025, the supply of power batteries in the United States will not be able to meet demand. Although compared to the Obama administration, the demand for lithium batteries in the United States has increased today. But even if there is another star lithium battery company in the United States now, it is still difficult to compete in the market competition-the times have changed.

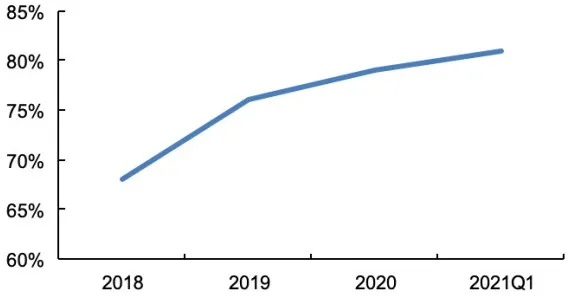

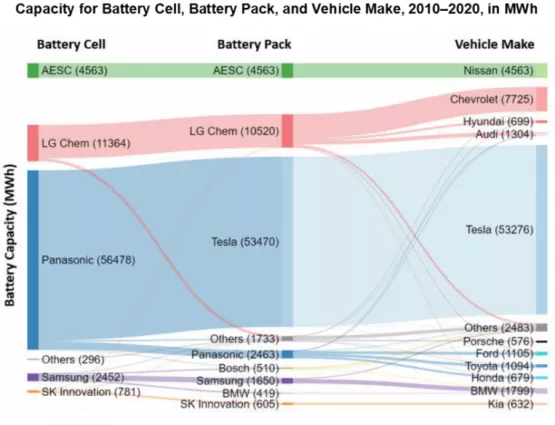

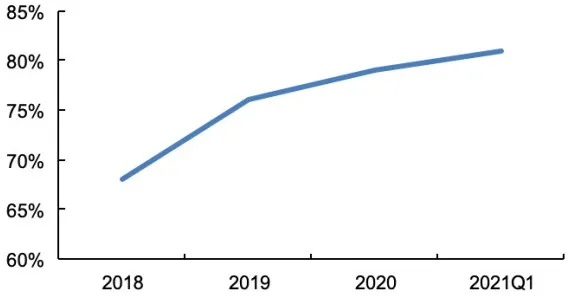

From 2018 to the first quarter of 2021, the market concentration of the world's top five power battery manufacturers has risen from 67% to 81%. If the market share of the top ten companies is calculated, this figure will account for 98% of the total market share in 2020.

Global power lithium battery CR5 market share

This fully shows that the market is more mature, and resources are gathered towards leading companies. It is time for lithium battery giants to compete in production capacity and cost. Therefore, to break the problem of local power battery production capacity in the short term, there is only one way left for American companies-holding the giant's thigh, building a joint venture for production, and embarking on an American version of the "introduction, absorption, and digestion" route.

A typical representative, Tesla super battery factory. In 2017, the super lithium-ion battery factory jointly established by Tesla and Panasonic was put into production. In order to fill the technology and talent vacancies brought about by the hollowing out of the American industry, Tesla directly brought in Panasonic's technicians and trainers. Tesla is responsible for engineering Panasonic's production lines and equipment.

Today, Tesla's first super lithium-ion battery factory has produced 1 million battery packs. American car companies + power battery giants jointly built factories, which have also been reproduced in the form of "Ford + SKI", "GM + LG New Energy", "Stellantis + Samsung SDI" and so on.

This model has a rhetoric in the "U.S. Lithium Battery Blueprint 2021-2030" released by the U.S. government: work with partners to jointly establish a raw material supply system, support local R&D work, and formulate relevant policies.

But the truth is: the U.S. lithium battery industry has no local cards to play.

More worrying is not just one trouble spot, but many trouble spots.

In the upstream resource layout of the power battery industry chain, the competition between China and the United States is mainly the competition; at the midstream battery manufacturing end, China, Europe, Japan and South Korea compete on the same field. It is difficult for the United States to form an advantage. The upstream problem of the lithium battery industry in the United States is that it cannot produce primary nickel with a nickel content of 100%. China has mastered the process of low-cost extraction of primary nickel.

In terms of battery manufacturing, China has advantages in production capacity, installed capacity, production process and cost control. Except for the Tesla super battery factory, there is no battery manufacturer in the United States that can participate in the global lithium battery industry chain. The competition in the market is becoming more and more fierce, and the three-legged situation between China, Japan and South Korea is difficult to break, and market resources are moving closer to the head.

The status quo of the failure of lithium batteries in the United States cannot be changed in the short term.

G: A sigh

Breeze from the Atlantic was salty and clammy over Detroit's Romulus. Inflated self-confidence and dreams numb the sense of smell of American lithium battery practitioners. That was September 2010.

Politicians participating in the A123 campaign are willing to believe that the renaissance of lithium batteries in the United States is just around the corner. They ignore the difficulty of reality - the hollowing of the industry brings about the problem of excessive production costs, and the products produced do not have the ability to compete in the market. The strong push policy has obscured the lack of technological breakthroughs in the lithium battery industry in the United States.

Annette faces the camera. She blushed with excitement. The picture swept across the production line behind her, with batteries surging on the assembly line. Annette has not appeared in any media since that interview.

The failure of A123 is the epitome of the broken dream of the revival of the lithium battery industry in the United States. Although the three major elements of policy, capital and technology are in place, this American star of hope for lithium batteries is ultimately unable to withstand the dilemma of American anti-globalization production: 1. The hollowing out of the industry 2. The increase in manufacturing costs.

At that time, the lithium battery industry had matured. In a sense, China, Japan and South Korea could win the global competition and occupy the lithium battery market, relying on their respective advantages in industrial systems, labor costs, technical talents and capital accumulation.

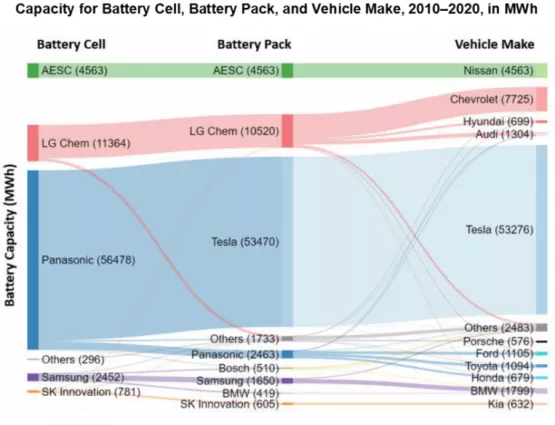

After A123, there is no lithium battery company in the United States that can handle it. In the more than 10 years since 2010, five Asian companies, Samsung, SK I, LG New Energy, Panasonic and AESC, have contracted almost all lithium batteries for electric vehicles in the United States.

From 2010 to 2020, 5 Asian companies provided lithium batteries for electric vehicles in the United States

After going round and round, the U.S. lithium battery industry has returned to its starting point. When Biden is in power, there is no pure American lithium battery company available. You know, Tesla's super battery factory is still a joint venture with Japan's Panasonic.

In the cyclical cycle of history, the past can be a harbinger of the future.

On the other side of the Pacific Ocean, China, after 20 years of hard work, now occupies more than 70% of the global market share of power batteries, and sits on the C position of the new energy feast. SES Power is located in Dongguan, China, and it is also developing synchronously with the development of China's lithium battery industry. We are full of respect for the company and product of A123, but the time has passed.

When the engineers of SES Power gathered to chat, they looked at the 12V30Ah and 12V50Ah car starter batteries (maximum peak current up to 1500A) that used high-performance lithium battery A123 a long time ago, it's almost all just an action, a sigh.