Indonesia has become the focus of the global lithium

battery industry, and LG and CATL have invested heavily in the local

industry chain

According to reports, the "K Battery Alliance",

which is participated by South Korea's LG New Energy Corporation, plans

to invest in the nickel resource industry chain in Indonesia. The core

of this plan is to invest 9 billion US dollars to deploy the whole

industrial chain of raw material nickel smelting, cathode material

production, battery cell and battery finished product assembly in

Indonesia.

The Indonesian government also confirmed on April 18

that an alliance composed of LG New Energy, LG Chem, LX International,

Posco Holdings and other South Korean companies has joined forces with

Indonesian nickel mine company Antam, Indonesian battery company IBC,

etc. Signed an investment agreement to build the battery industry value

chain.

However,

this agreement is carried out in a "non-binding" manner, and all

parties need to conduct follow-up negotiations on specific content such

as shareholding relationship and business structure. It is expected

that it will take some time before the final signing.

The "K

Battery Alliance" is promoted by the Korean government to support

companies in accelerating the development of new-generation batteries

such as NCMA (nickel, cobalt, manganese, aluminum) batteries,

all-solid-state batteries, and lithium-sulfur batteries. At present,

Korean battery companies mainly produce "high-nickel batteries" with a

nickel content of more than 80%, and are approaching the goal of a

nickel content of more than 90%.

Market research firm SNE

Research predicts that by 2030, the demand for nickel from three

companies, LG New Energy, SKO, and Samsung SDI alone, will reach

648,000 tons, more than seven times that of this year. Indonesia is rich

in lithium and nickel resources and has the world's largest nickel ore

reserves and output. It is expected that the growth of nickel ore raw

material production in the future will come from Indonesia.

According

to data from the United States Geological Survey, the world's nickel

resource reserves in 2020 are about 94 million tons, of which Indonesia

ranks first with about 21 million tons, accounting for 22%. Compared

with the data of the US Geological Survey from 2015 to 2020, the

increase in global reserves is about 17 million tons in five years, and

Indonesia's production will increase by 16.5 million tons. In

addition, its lithium ore reserves are about 21 million tons, ranking

first in the world.

SES Power has a long experience in the

design and manufacture of customized lithium batteries, many of which

use 18650 lithium-ion batteries produced by Samsung or LG in South

Korea. We know that South Korea's battery technology is mainly based on

high-nickel lithium batteries. The so-called ternary lithium battery

refers to a "ternary material" composed of three elements, nickel,

cobalt and manganese, in the positive electrode of the lithium battery.

Due to the performance advantages of nickel in improving the energy

density of batteries, high-nickel batteries are gradually becoming an

important development direction of ternary lithium batteries. While

high-nickel lithium batteries reduce the use of expensive cobalt,

nickel resources are just as tight. SES Power prefers to use lithium

iron phosphate batteries with high safety, long cycle life, low cost

and more environmental protection. We use 12V100Ah, 24V100Ah, 36V100Ah,

48V100Ah of EVE, CATL, BYD square aluminum lithium battery, these

products can be used to replace lead-acid, cost and safety are the first

considerations.

Of course, any investment needs a reason. The

reason why Korean lithium battery manufacturers consider establishing a

complete lithium battery industry chain in Indonesia is not only the

income, but also the following background factors.

A: The global demand for lithium batteries is increasing rapidly

With

the global energy transformation and upgrading and the continuous

improvement of carbon emission requirements, the demand for new energy

vehicles and lithium battery energy storage systems has increased

rapidly, and the demand for lithium-ion batteries and battery raw

materials metals has also increased significantly. Sumitomo Metal

Mining, Japan's largest metal smelter, said a few days ago that global

demand for nickel for batteries is expected to grow by more than 20%

this year due to strong demand, and is expected to climb from nearly

330,000 tons in 2021 to more than 410,000 tons in 2022.webcam factory

B: Inflation + epidemic, constantly pushing up raw material prices

At

present, the price of lithium carbonate, the core raw material of

batteries, has continued to increase for 16 months, and the price has

increased by nearly 10 times. The prices of important metal materials

such as nickel and cobalt also showed a continuous upward trend. In the

case of the continuous increase in the price of upstream raw materials

and the imbalance between supply and demand, the new energy industry

is facing the dual pressure of supply shortage and rising cost. It has

become the consensus of major power battery manufacturers around the

world to ensure the stability of the supply chain by deploying overseas

mineral resources.

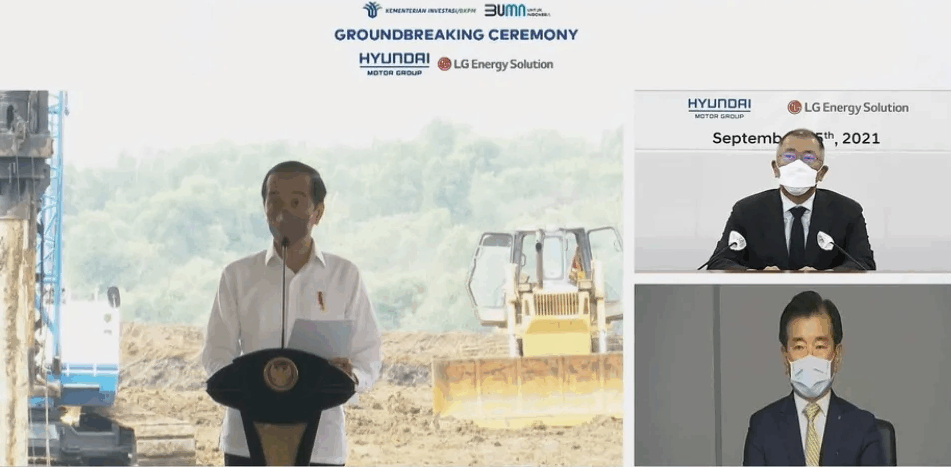

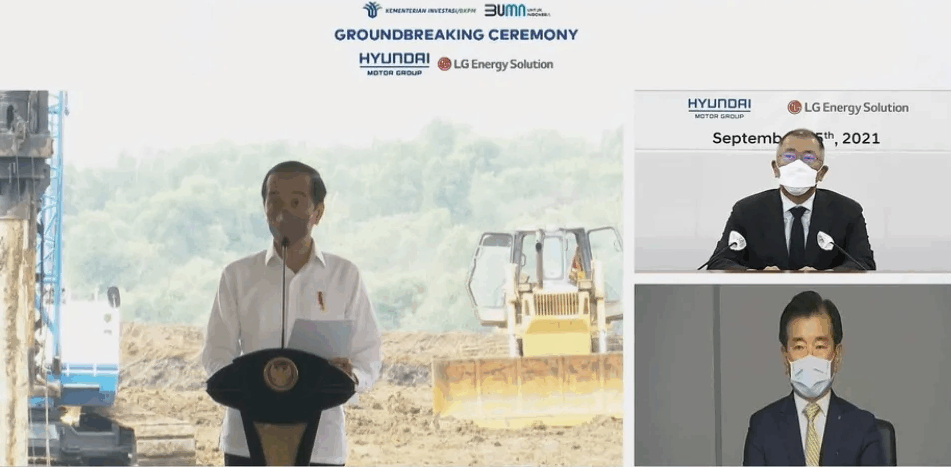

Building factories and investing in

Indonesia has become the common choice of many lithium battery

manufacturers, lithium battery material suppliers, and even OEMs. South

Korea's Hyundai Motor Company and LG New Energy are building a 10GWh

battery cooperation factory in Indonesia; CATL has also decided to

invest 5.9 billion US dollars to produce electric vehicles in

Indonesia.