Briefly describe the status quo of my country's domestic lithium battery

energy storage industry

As a new energy powerhouse, China's new energy industry has developed

rapidly in recent years, and the field of energy storage has also been closely

watched. In the face of huge market demand and potential, domestic energy

storage companies such as the sleeping lion are ready to take off. The status

quo was discussed in terms of capacity, market distribution, technology and

cost, and business model.

A few days ago, Tesla’s commitment to build the world’s largest battery

energy storage system in Australia within 100 days has been talked about by

industry insiders. The energy storage system injects the most primitive vitality

into the new energy ecosystem of its "Tesla Empire". It further marks the

important position of the "energy storage" link in the new energy industry.

As a new energy powerhouse, China's new energy industry has developed

rapidly in recent years, and the field of energy storage has also been closely

watched. In the face of huge market demand and potential, domestic energy

storage companies such as the sleeping lion are ready to take off. The status

quo was discussed in terms of capacity, market distribution, technology and

cost, and business model.

Energy storage market-the total capacity is considerable, and the user side

potential is huge

China's energy storage market is huge, and the data from the China Energy

Outlook 2030 released by the China Energy Research Society shows:

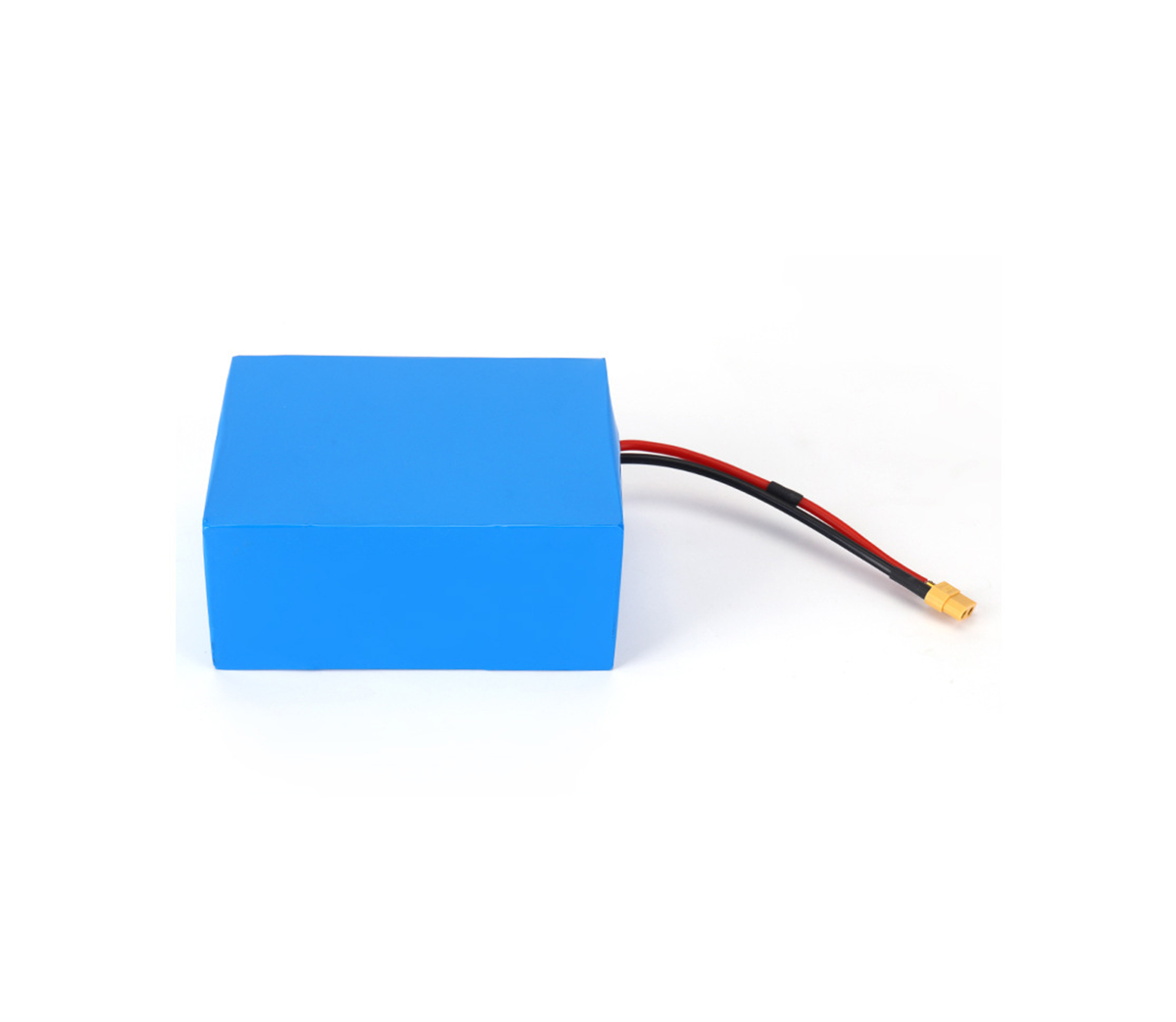

Ternary lithium batteries and lithium iron phosphate batteries form a

tripartite situation.

Although the high cost of lithium-ion batteries is a serious challenge

facing the development of the industry, many companies have been committed to

improving the cost-effectiveness of lithium-ion batteries. According to

EnergyTrend analyst Duff (Lu Lishun) analysis of the price of lithium batteries,

the price of lithium batteries has a slight upward trend in the first, second

and third quarters of 2017, but in general, in recent years, with the market’s

Demand continues to expand, and the cost of large-scale mass production of

lithium batteries is decreasing year by year, and the current price is

sufficient for commercial development and widespread use.

In addition, after the power lithium battery has decayed to less than 80%

of the initial capacity, it can be used in the field of energy storage cascades,

further reducing the cost of energy storage lithium batteries. Technology life,

policy determines the market. After long-term development and progress of

photovoltaic technology, the main technical framework and its economics have

been widely recognized. It has achieved better development with the dual

assistance of national policies and the market. Unlike photovoltaic technology,

the current storage Energy technology is still in the stage of continuous

breakthroughs. There is still room for narrowing the gap between domestic and

foreign technologies. From lithium iron phosphate batteries to ternary lithium

batteries, and to the current hotter lithium titanate materials, technological

changes are always affecting the development of lithium batteries. The cost is

balanced with the industrial chain, so investors have to face the risk of

technology upgrading when they are put into production in large quantities, and

they will be dumped a dimension if they are not careful.

In addition, many companies are still waiting for the state to introduce

subsidy policies, such as subsidizing the photovoltaic industry to provide

large-scale subsidies to the energy storage industry, so they are still in a

wait-and-see attitude. In fact, regardless of whether there will be subsidies,

companies that are the first to enter the market are bound to do so. Seize the

market heights.

The status quo of the business model: the closed loop of the industry chain

is moving forward steadily

At present, the country has not issued any subsidy policy for the energy

storage industry. Whether the energy storage industry can develop as fast as new

energy vehicles in recent years is still unknown, but companies that give

priority to entering the market will undoubtedly occupy the market heights and

be more sustainable and effective. The author believes that there are no more

than three types of companies that can enter the market first: including

business giants with strong financial resources, similar to Wanda CIMC, and

companies with core technologies, and finally companies with a complete

industrial chain (from photovoltaics to From energy storage to user-side

products, to achieve a full set of supply, self-produced and self-sold, the cost

pressure brought by the energy storage link can be shared).

At present, most of the energy storage companies appearing in the market

are joint ventures, which is the third type mentioned above. Joint ventures and

equity participation can give full play to the resource advantages of both

parties in the strategic cooperation, sharing battery technology, energy storage

systems, sales networks, etc. Commonly used superior technologies in the energy

storage market segment. LG Chem, Samsung SDI, Yiwei Lithium Energy, and Guoxuan

Hi-Tech have all adopted this approach. The following figure is an example of

cooperation methods of some manufacturers.