On September 15, a rumor that “the United States will completely ban battery components and mineral raw materials from China” spread on the Internet.

Some analysts believe that the US "Inflation Reduction Act" (IRA Act) has set strict exclusionary terms for China's power battery industry, including a complete ban on battery components produced in China from 2024; and a complete ban from 2025. Mineral raw materials from China, etc.

SES Power has learned from multiple sources that the above statement is not accurate. The US restrictions on China's power battery industry are not banned, but not subsidized. Although China is not explicitly mentioned in the relevant provisions of the Act, the United States has set a series of "exclusive" provisions in the conditions for obtaining subsidized models to protect the new energy vehicle industry chain of the United States and its "partner countries" system, to suppress and exclude China and other "foreign entities of concern" that have a first-mover advantage in the upstream and downstream of the industrial chain.

As an old-fashioned lithium battery energy storage system and power system manufacturer, SES Power has long predicted that the United States will impose restrictions on some areas, because our products, such as wall-mounted home energy storage systems 48V100Ah, 48V200Ah, stackable Home energy storage system (5KWh per module, up to 15 modules superimposed), lead-acid replacement products (lithium iron phosphate battery 12V100Ah, 12V200Ah, 24V100Ah), UPS high-voltage lithium battery system (up to 860V), 3Kw~20Kw off-grid, parallel network, island-type lithium battery energy storage system, backup battery system (standard 19 inches), etc. These products have a wide customer base in the European and American markets, so we can feel this trend very early.

Can the U.S. government achieve its desired goals? Let's analyze it below.

A: The United States is trying to create an independent electric vehicle industry chain

In order to achieve Biden's goal of making electric vehicles account for half of all new car sales in the United States by 2030, the IRA Act has made unprecedented efforts to stimulate the development of the new energy vehicle industry in the United States through financial subsidies.

Under the IRA Act, the U.S. government will provide tax credits of $7,500 and $4,000 to consumers who purchase new and used electric vehicles, respectively.

However, starting from 2024, the United States has clear requirements for the components and raw materials that can be used for subsidized new energy vehicles, such as power battery components and their key minerals (cells, modules, electrolytes, diaphragms and lithium necessary for the production of power batteries). , nickel, cobalt, graphite anode and cathode materials, etc.) must have a certain proportion from the United States or countries that have free trade agreements with it (Canada, Mexico, Australia, South Korea, Chile, etc.), and the proportion is increasing year by year.

The tax credit is disqualified if the materials and critical minerals in the battery are extracted, processed or recycled by a "foreign entity of concern".

SES Power noted that President Biden signed the Chip and Science Act a week before the IRA Act was signed.

The Congressional Budget Office stated that the "Chip Act" will provide US$52.7 billion in subsidies for US chip manufacturing, R&D and workforce development, give 25% investment tax incentives to companies setting up chip factories in the United States, and allocate about US$200 billion to promote the United States. A total of nearly 300 billion US dollars will be invested in scientific research and innovation in the fields of artificial intelligence and quantum computing in the next 10 years.

According to the requirements of the bill, 40% of the mineral materials used in batteries need to be mined and processed by countries with free trade agreements in the United States. The proportion will be increased to 50% by 2024, 80% by 2027, and 100% of battery components must be in North America by 2029. manufacture.

Some experts pointed out that although the "exclusive" clauses of the two bills do not clearly point to China, from the perspective of the current structure of the new energy vehicle industry chain in the United States, Chinese companies have become an important part of it. The United States introduced these restrictions in the hope of administrative means. And subsidy restrictions are forcibly "unbound" with China's power battery industry chain, with the intention of establishing a complete and independent electric vehicle industry chain.

B: China's advantages are too obvious

What is the status of China's power battery installed capacity in the world?

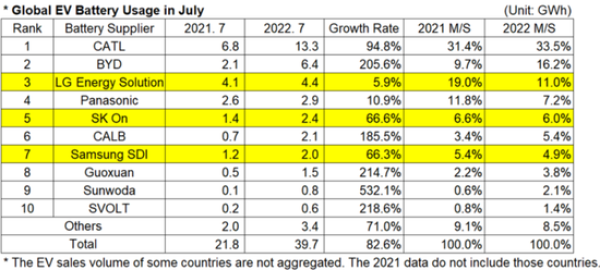

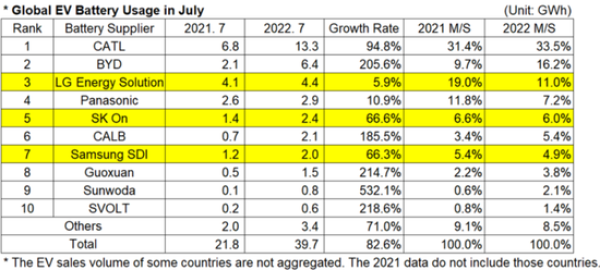

According to data released by SNE Research on September 5, in July this year, Chinese companies accounted for 6 of the top ten global electric vehicle battery manufacturers in terms of installed capacity. One throne, and BYD's battery installed capacity reached 6.4GWh, after January and April this year, it once again surpassed South Korea's LG Energy to become the second in the world.

In addition, the installed capacity of four domestic power battery companies, China Innovation Aviation, Guoxuan Hi-Tech, Xinwangda, and Honeycomb Energy, increased by more than 180% year-on-year in July, ranking among the top ten in the list.

(Top 10 list of global electric vehicle battery manufacturers in terms of installed capacity in July)

South Korea's three battery manufacturers LG New Energy, South Korea's SK ON (2.4 GWh), Samsung SDI (2 GWh) ranked third, fifth and seventh respectively; Japan's Panasonic (2.9 GWh) ranked fourth.

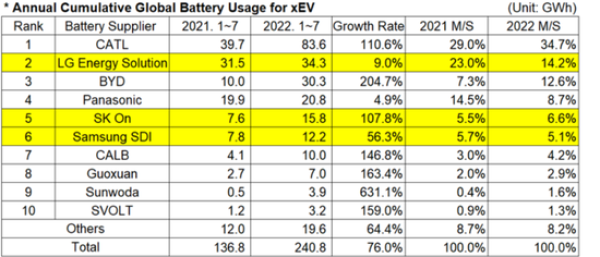

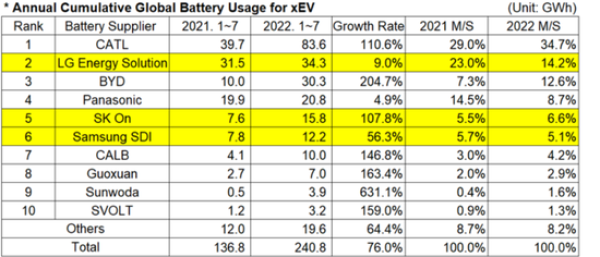

(Top 10 global EV battery manufacturers by installed capacity from January to July)

According to the cumulative data from January to July this year, the global installed capacity of power batteries was 240.8GWh, a year-on-year increase of 76%; CATL ranked first with 39.7 GWh, a year-on-year increase of 110.6%, and South Korea's LG Energy ranked second with 31.5 GWh, a year-on-year increase. With an increase of only 9.0%, BYD ranked third with 10GWh, but a year-on-year increase of 204.7%. As far as the growth momentum is concerned, BYD is just around the corner to surpass LG Energy in an all-round way.

In terms of production capacity, with the continuous expansion of market demand, there is a gap in the supply of power batteries. SNE Research predicts that if the production capacity plan at the beginning of 2021 is calculated, by 2025, the production and sales gap of power batteries will reach 37%, and the loading gap will reach 25%, and the supply and demand will continue to be tight.

We believe that these "exclusive" provisions of the "2022 Inflation Reduction Act" will force relevant companies to transfer to the United States and countries that have free trade relations with it to a certain extent, but China itself is still the world's largest new energy vehicle market, with a complete The upstream and downstream industrial chain is enough to support the development of its own supply chain, and the self-built new energy vehicle supply chain in the United States will not shake China's leading edge.

C: Can the United States achieve decoupling from Chinese batteries and their raw materials in the short term?

According to Bloomberg New Energy Finance data, at present, Tesla is the only company in the United States that has the ability to commercialize mass production of power batteries. Head battery manufacturers are joint ventures or invested by battery companies such as Britishvolt in the UK and iM3NY in Australia.

According to the statistics of Bloomberg New Energy Finance, the top ten companies in the current US power battery capacity (including fully commissioned, under construction and announced battery capacity) are all from the above-mentioned "foreign" joint ventures or wholly-owned companies. The production capacity of South Korean battery manufacturers alone accounts for 59.7% of that, but more than 80% of the battery mineral raw materials used by South Korean battery manufacturers last year were imported from China.

According to public information, in terms of key raw materials for power batteries, 59% of the world's lithium, 68% of nickel, 73% of cobalt, 93% of manganese and other cathode materials are supplied by China. In terms of anode materials, China also has an irreplaceable advantage, and nearly 100% of graphite is produced in China.

D: final conclusion

To sum up, SES Power believes that in the short term, it is expected that the United States' dependence on China in related industrial chains such as electric vehicles and lithium battery energy storage systems will be difficult to change.

The reason is very simple. China's supply chain companies have strong first-mover advantages, mature technologies, and outstanding cost advantages.

CleanTechnica, a global electric vehicle and battery analysis agency, more directly stated that the United States cannot make batteries without raw materials from China.

Lithium-ion batteries and new types of secondary rechargeable batteries will be the trend in the future. If you have any ideas, please contact SES Power.