Global power lithium-ion battery production and industrial chain are very dependent on China, but we also need to look at some other trends, of which Japan and South Korea are the focus.

SES Power has nearly two decades of experience in the lithium-ion battery industry. We have used Korean-made lithium-ion batteries for a long time because of their high quality and price advantages compared to Japanese cells. Although now we mainly use lithium iron phosphate batteries, such as lead-acid replacement (lithium iron phosphate batteries 12V100Ah, 12V200Ah, 24V100Ah), custom lithium batteries that work normally in -40℃ environment, UPS high voltage lithium battery system (up to 860V), 3Kw~20Kw off-grid, grid-connected, island-type lithium battery energy storage system, wall-mounted home energy storage system 48V100Ah, 48V200Ah, stacked energy storage system (single unit is 51.2V100Ah, up to 15 stacks) and so on.

However, we are still full of respect for our Korean counterparts. Let SES Power analyze the progress of Korean counterparts in depth under the premise of combining the general environment.

(1) China is still the largest producer of lithium-ion batteries

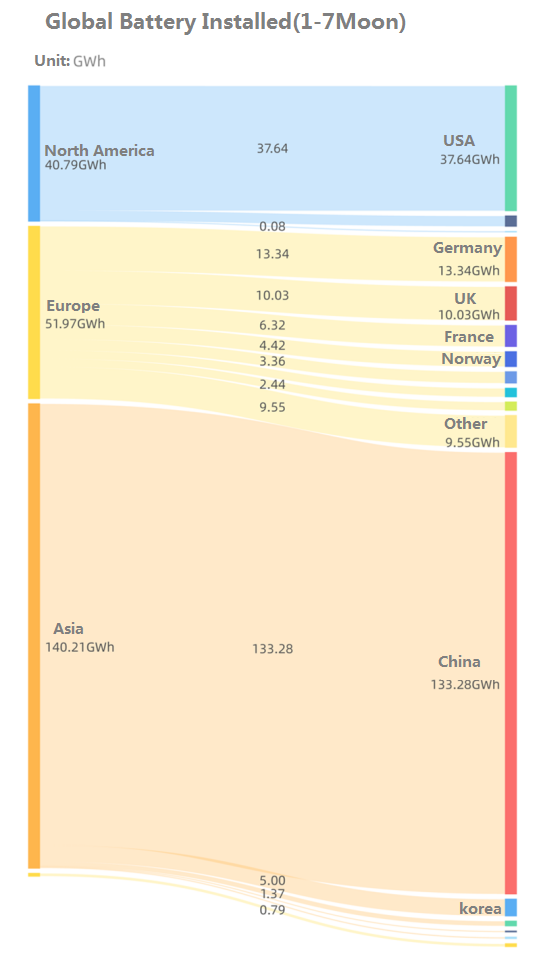

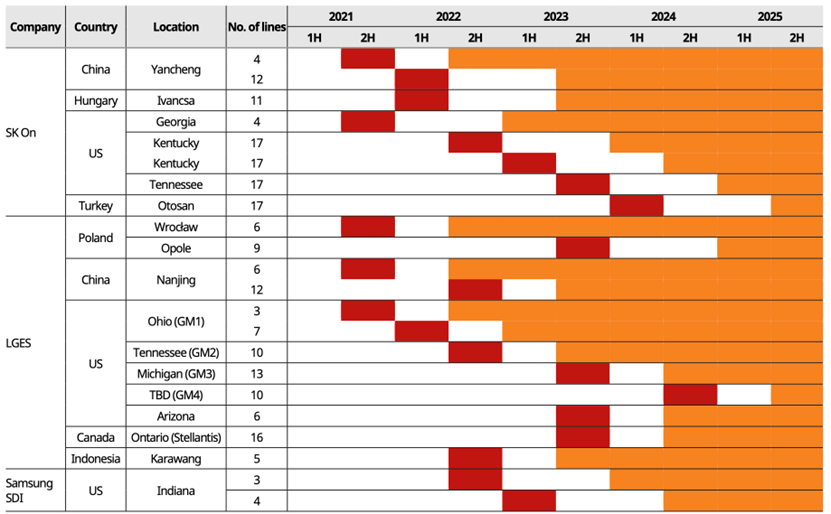

Let's take a look at the background first. According to the data of professional media, from a global perspective, China has the largest share of lithium-ion battery installed capacity. From January to July, the installed capacity of power lithium-ion batteries in Asia (mainly China) was 140.21GWh. A year-on-year increase of 116%. The installed capacity of power lithium-ion batteries in North America reached 40.80GWh, an increase of 81% year-on-year. In Europe, due to factors such as inflationary pressure, economic recession and changes in subsidy policies, the installed capacity of lithium-ion batteries was 51.98GWh, a year-on-year increase of 25%, far behind other regions.

Figure 1. Global Li-ion Battery Installations

From the data point of view, the largest increase in 2022 is the application of power lithium-ion batteries in the Chinese market. Judging from the estimated growth rate from 2023 to 2025, with the rapid advancement of the electric vehicle market in the United States, the production capacity of South Korean lithium-ion battery companies will gradually be realized in the United States and Europe. And China's lithium-ion battery companies have begun to expand their production capacity to other fields.

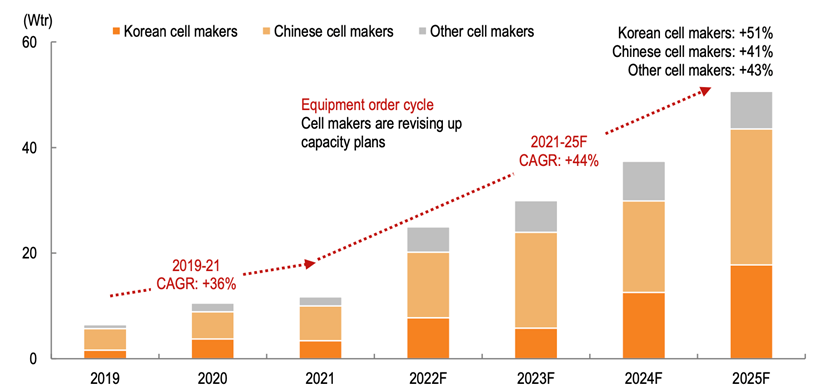

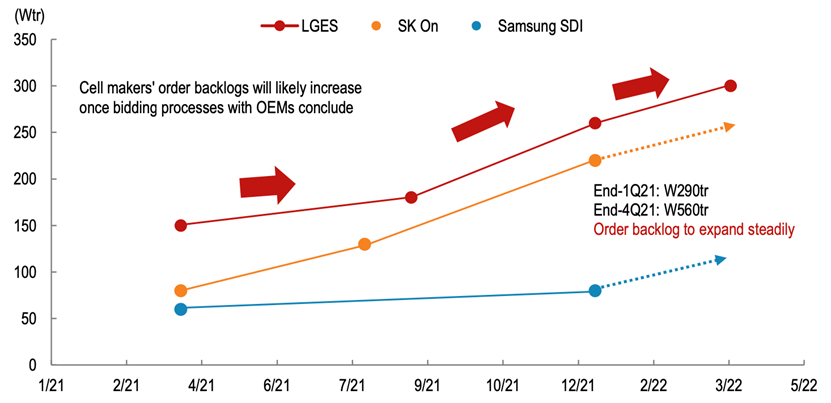

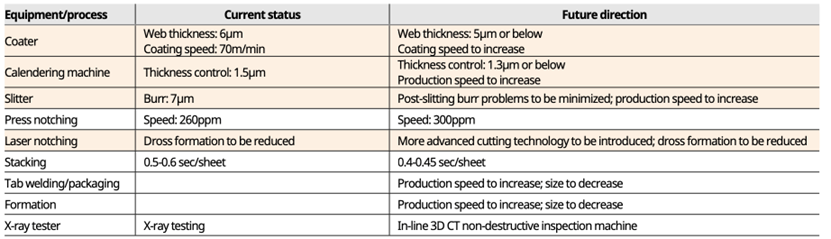

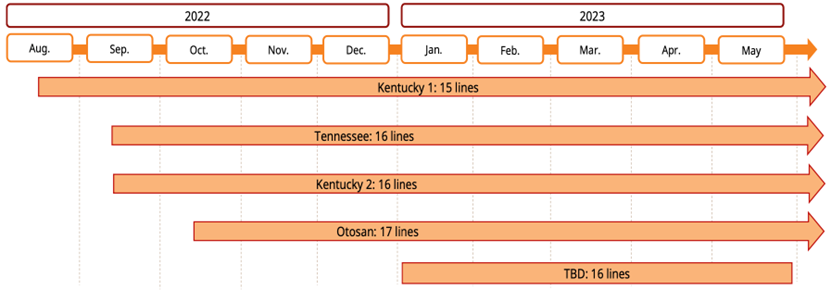

▲Figure 2. Estimated orders for lithium-ion battery equipment

And this can also be drawn from the demand estimate of lithium-ion battery production equipment in Figure 2.

(2) South Korean lithium-ion companies are obviously accelerating their deployment

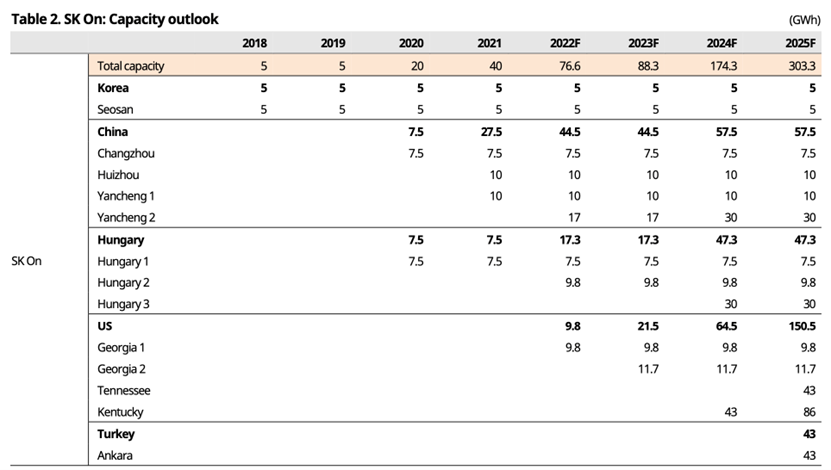

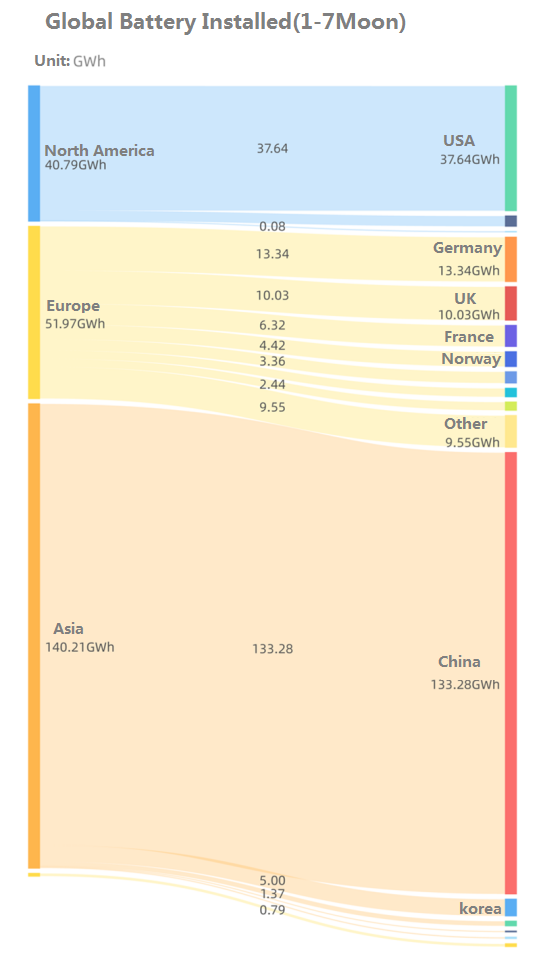

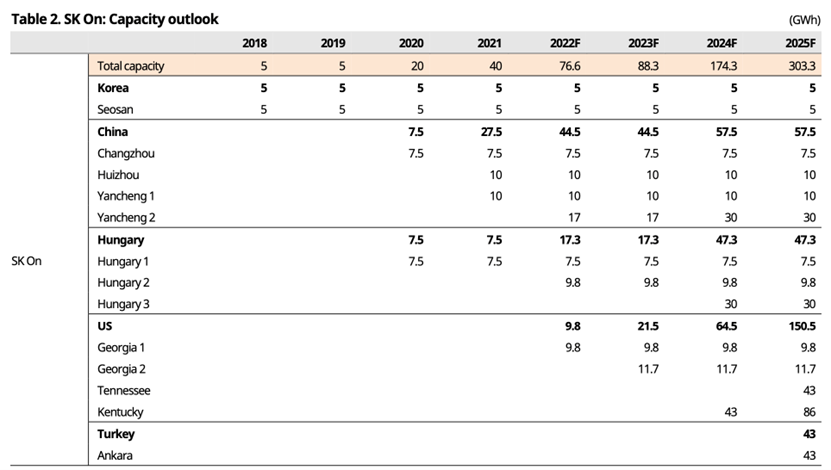

South Korea's lithium-ion battery industry has begun a new round of steps to increase production capacity. SK On, which is independent and actively supported by the consortium behind it, is particularly aggressive, which can be concluded from the estimation of equipment orders.

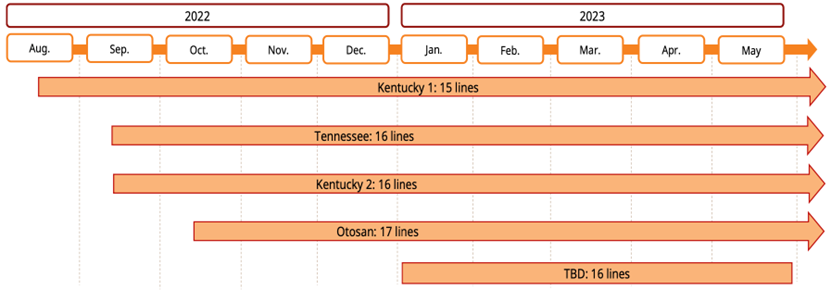

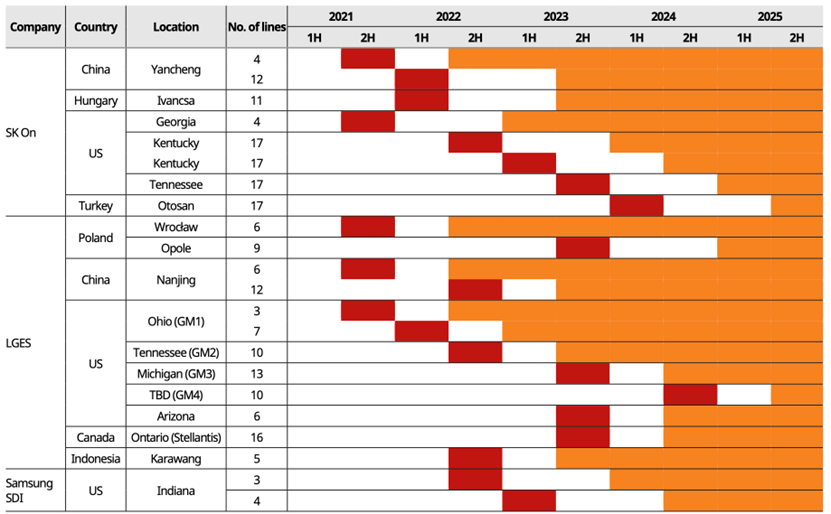

SK On started construction of more than 100 production lines in 2022, and they plan to deploy more than 100 production lines in 2022 and 2023, except for 12 in Yancheng, China and 11 in Ivansa, Hungary, then 80 production lines need to be built in the second half of 2022. multiple lines. BlueOval SK's Kentucky and Tennessee plants will have a total of 47 assembly lines.

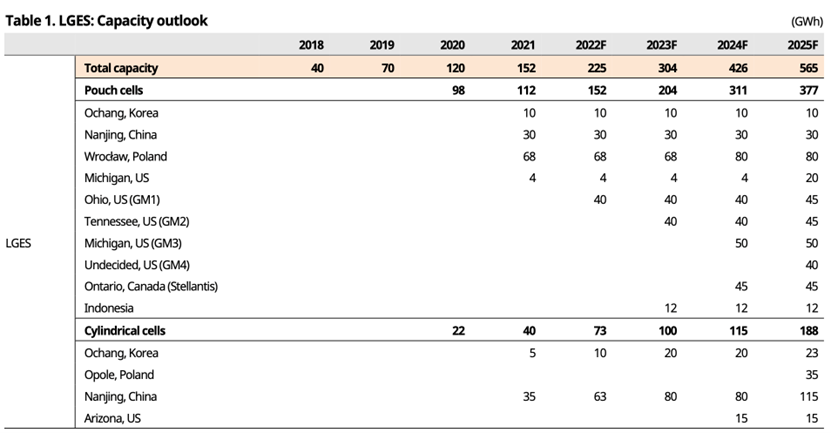

LG ES started placing orders for the Karawang plant in Indonesia and the Tennessee plant (GM2) in the United States, and began to prepare for official mass production at the Michigan plant (GM3), and Samsung SDI also began placing orders for its joint venture, Stellantis.

Figure 3. Construction cycle of SK On

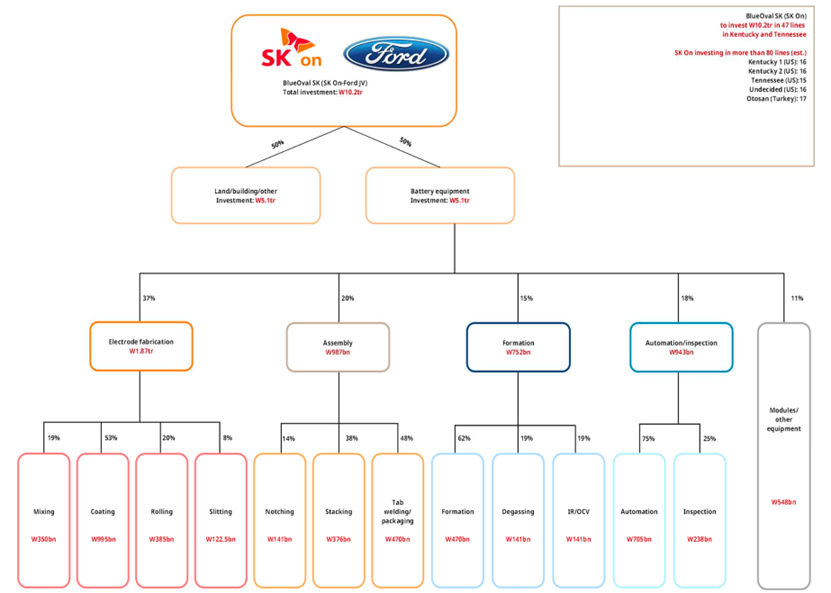

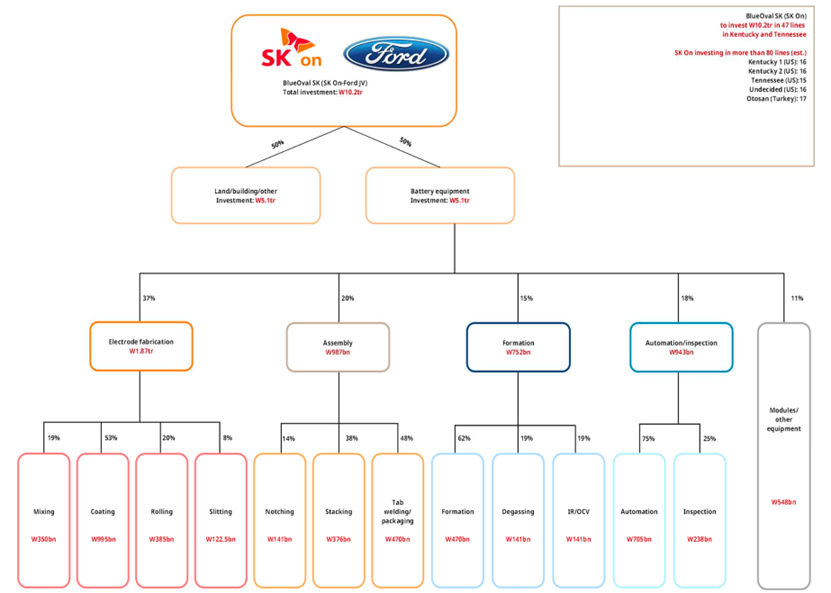

SK On's astonishing investment is in a sense directly driven by demand from Ford. From the perspective of value decomposition, electrode preparation accounts for 37%, battery cell assembly accounts for 20%, battery cell formation accounts for 15%, battery cell capacity detection accounts for 18%, and lithium-ion battery pack accounts for 11%. This can be intuitively answered from Figure 4 below.

Figure 4. Disassembly of a Li-ion battery device

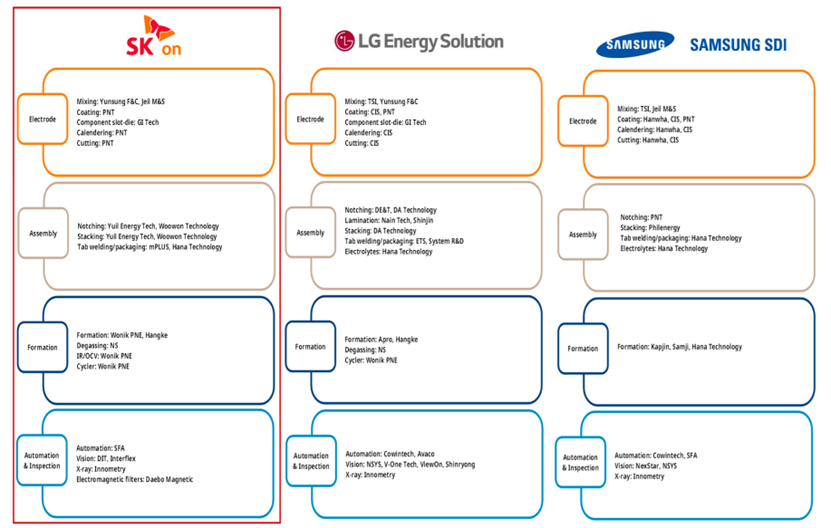

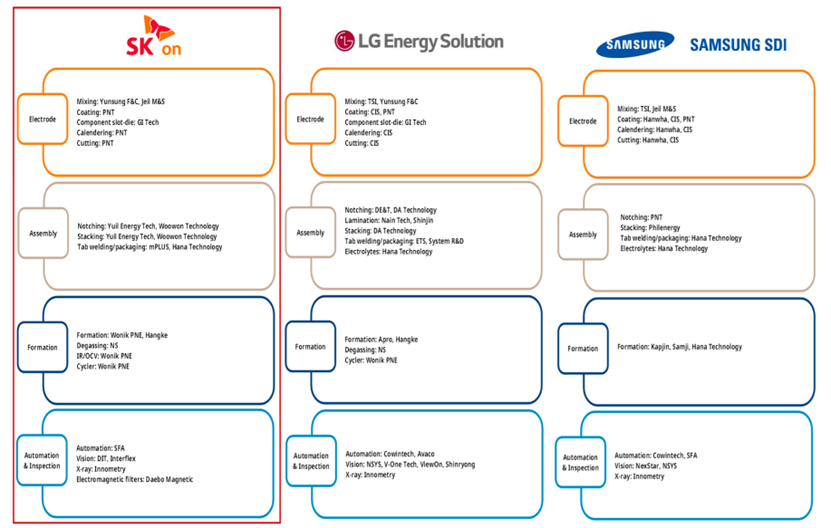

Figure 5 is also interesting because it mainly shows the equipment supply system of three different Korean lithium-ion battery companies.

Figure 5. Equipment supply system of Korean lithium-ion battery companies

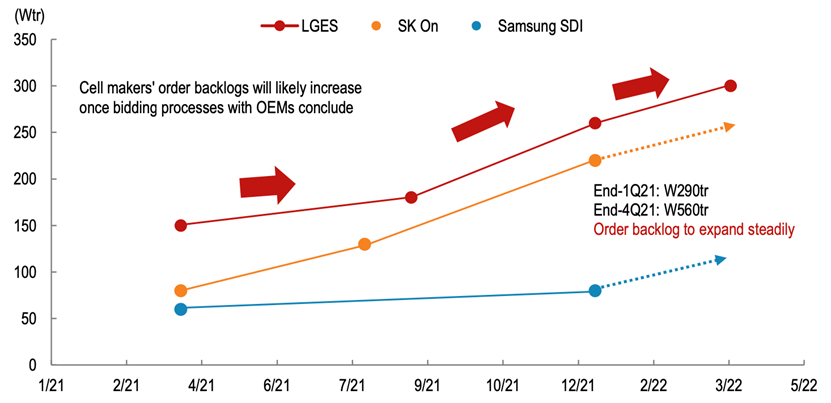

(3) Order trend of Korean lithium-ion battery companies

Previously, GM made every effort to promote LG's production capacity construction, and LG's thriving, this round of SK On's investment mainly focused on the needs of Ford and the public. Of course, we can also clearly see that in the new round of orders at the beginning of this year, the increase of SK On is obvious.

Figure 6. Order Pool of Korean Li-ion Battery Companies

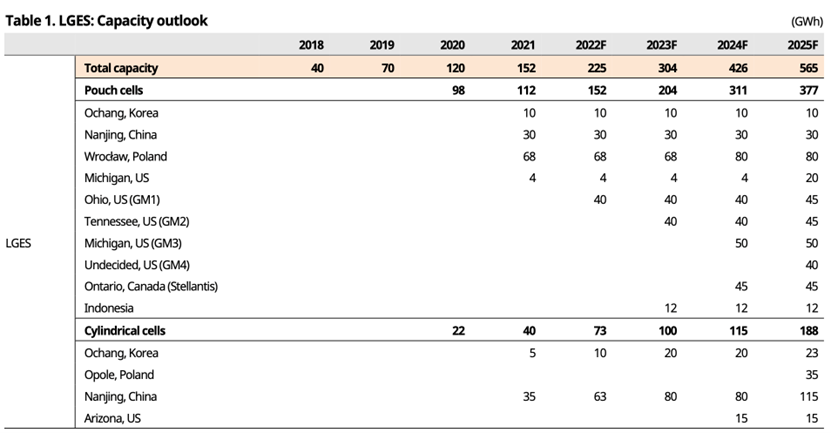

The estimated production capacity of the two major Korean lithium-ion battery companies is as follows:

LG has a new change, that is, the increase in production capacity of its three joint venture factories with GM, Stellantis and Hyundai is all placed on the cylindrical lithium-ion battery side. The production capacity of cylindrical lithium-ion batteries in the Polish plant in Europe has been increased.

What SES Power is curious about is whether the production capacity of the cylindrical lithium-ion battery factory in Nanjing, China can be smoothly switched to the now very popular 4680 model.

Figure 7. LG's capacity planning and landing tracking

The situation of SK is very clear in the previous introduction, so there is no need to repeat it. We can fully understand the ambition of SK On by looking at the icon below.

Figure 8. SK On's capacity planning and landing tracking

The following table is very interesting, mainly the order situation of lithium-ion battery equipment orders of three Korean lithium-ion battery companies.

Figure 9. Equipment orders of Korean lithium-ion battery companies

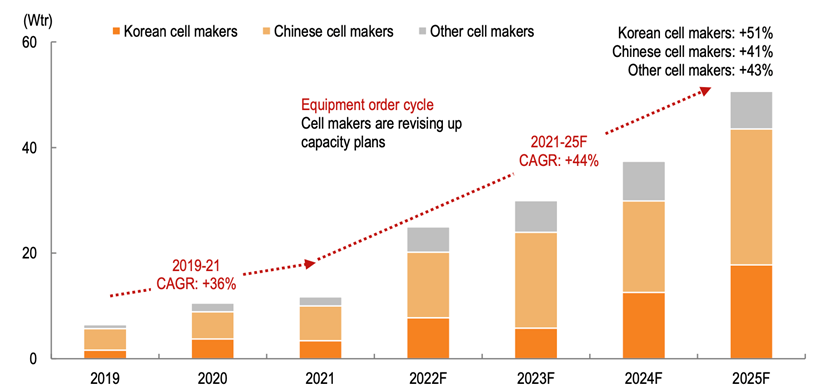

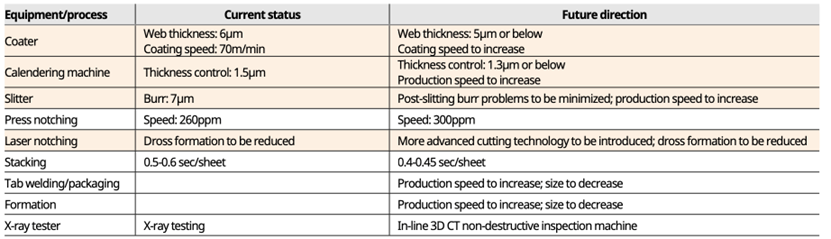

Under the influence of the huge demand in the two major directions of power + energy storage in recent years, the lithium-ion battery industry is obviously insufficient in production capacity, but it is obviously a wrong choice to only care about production capacity and ignore the improvement of quality. Korean lithium-ion cell makers certainly don't make such mistakes.

This can be seen from some improvements in different aspects of lithium-ion battery equipment in Figure 10, we know that they really think about the balance between production capacity and quality.

Figure 10. Some Progress Directions in Li-ion Battery Technology

SES Power finally summarizes for you: Judging from the current development speed, the first-mover advantage of China's lithium-ion battery production capacity is already obvious; this round of production capacity construction in South Korea and Japan revolves around the needs of the United States. Whether South Korean lithium-ion manufacturers can shorten the distance with their Chinese counterparts, we will see in two years.

If you have any questions about lithium-ion battery products or industry information, you are welcome to contact SES Power.