BNEF: Raw materials rise, the average price of battery packs may rise to

US$135/kWh in 2022

In 2021, supply chain shocks have caused the price of lithium-ion battery

packs to rise in the short term, but overall, the price is still on a downward

trend, and the average price by 2024 may fall below US$100/kWh.

Including battery-powered electric vehicles (BEV) and stationary battery

energy storage systems (BESS), BloombergNEF has conducted surveys on battery

prices in multiple areas and reached the above conclusions in its latest annual

survey report.

Last year’s survey found that some battery packs were quoted at less than

US$100/kWh. In 2020, the average price in the global BEV and BESS markets was

US$137/kWh, a decrease of 89% from 2010.

BloombergNEF said that the average price in 2021 has dropped to US$132/kWh

(after analysts adjusted it to about US$140/kWh), a 6% decrease or even a slight

increase from last year. From a regional perspective, battery packs in China are

the cheapest, battery packs in the United States are about 40% more expensive,

and battery packs in Europe are 60% more expensive.

Specific to BEV, the average price of the battery pack is 118 US

dollars/kWh, and the battery is 97 US dollars/kWh. This shows that the

proportion of batteries in the total cost (82%) is higher than the level of

about 70% in the past few years.

The decline in costs shows that electrified transportation and stationary

battery applications will have a bright future, but in the second half of this

year, many industries have seen significant commodity price increases.

Batteries are not immune, and the cost of electrolytes and other important

materials is rising. According to BloombergNEF's forecast, the increase in raw

material prices means that in 2022, the average price of battery packs may rise

to US$135/kWh. The business of BEV and BESS may be affected as a result.

People hope that the challenges of the supply chain are only short-term. A

month ago, BloombergNEF analysts also produced another report predicting the

global boom in BESS installations. The report referred to the 2020s as the

"decade of energy storage."

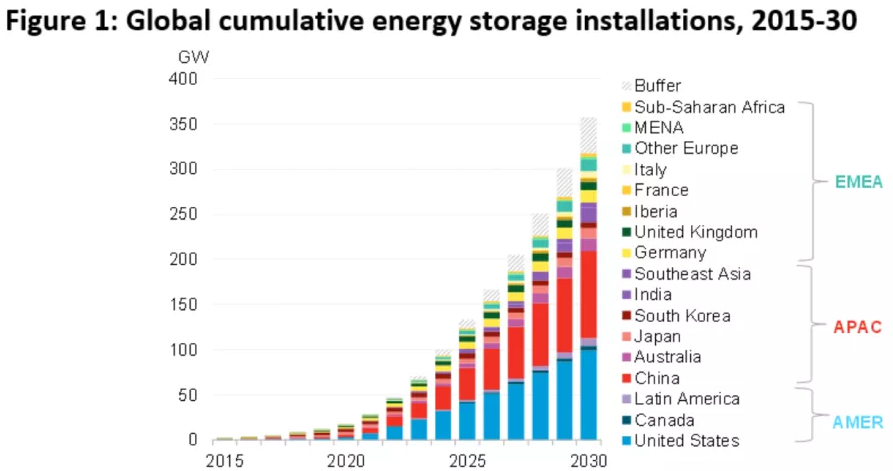

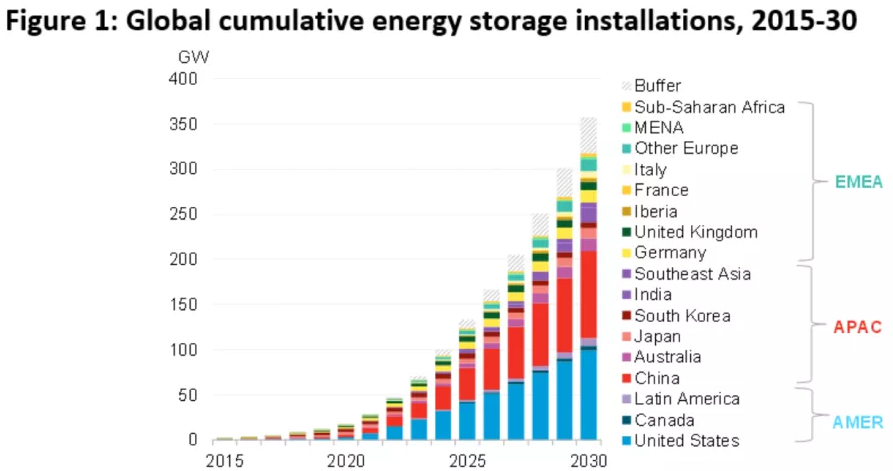

BloombergNEF predicts that by 2030, the cumulative global deployment will

reach 358GW/1028GWh, and the investment will exceed US$260 billion. As of the

end of 2020, 17GW/34GWh capacity has been connected to the grid.

In the past few years, an interesting trend in lithium-ion batteries: the

increase in demand for lithium iron phosphate (LFP) batteries.

The energy density of the LFP battery is lower than that of the NMC, but

the cost is also lower. Because it was deemed unsuitable for BEV, car

manufacturers once avoided this battery. However, partly because they are more

resistant to high temperatures than NMC, LFPs are beginning to be used more

widely in BESS.

As McKinsey experts pointed out in the Energy-Storage webinar earlier this

year, BEV manufacturers are beginning to consider using LFP batteries in

short-range and entry-level market vehicles.

BloombergNEF pointed out that in 2021, LFP batteries will be nearly 30%

cheaper than NMC batteries. However, the price of raw materials has a very large

impact on LFP. Since September, Chinese manufacturers have increased the price

of LFP batteries by 10%-20 %.

BloombergNEF said that historical trends indicate that by 2024, the average

price of various types of lithium-ion batteries may fall below US$100/kWh. Of

course, if raw material prices continue to rise, this decline may be delayed for

two years.

US$100/kWh is about BEV’s competitive cost threshold, and this price will

bring profits similar to internal combustion engine vehicles. BloombergNEF said

that it can continue to reduce battery costs and improve technology through

R&D investment, and it can also achieve large-scale development through

capacity expansion.

In October, the BloombergNEF research team released the second annual

ranking of the global lithium-ion battery supply chain. China continues to lead

the world in terms of industry participation. Including the United States and

Europe, many other countries have also begun to enter this market of important

strategic significance and economic interest.

Lithium-ion battery (LIB) has become the main energy storage solution in

modern social life. Among them, lithium iron phosphate batteries are a perfect

replacement for lead-acid batteries, and they are the first choice for

grid-connected peak shaving, off-grid energy storage, photovoltaic energy

storage, UPS, data center and other industries.