While the United States already possesses a range of clean energy technologies, social, economic, and political barriers may affect the development and deployment of these technologies.

Experts who hold this view highlight two major barriers to deploying battery energy storage systems: cost and materials. In particular, the cost in mainstream battery energy storage technology remains prohibitively high.

SES Power predicted that battery energy storage would be a hot spot in the market a long time ago, so we started to improve the supply chain early. Although the raw materials of lithium-ion batteries have risen sharply recently, with the cooperation of our suppliers, we are very happy. Good deal with this market volatility problem.

We often match solar photovoltaics, inverters, UPS, smart chargers, etc. for our customers' lithium battery products. In fact, these all belong to the category of lithium battery energy storage systems. Wall-mounted home energy storage system 48V100Ah, 48V200Ah, stacked home energy storage system (5KWh per module, up to 15 modules stacked), lead-acid replacement (lithium iron phosphate battery 12V100Ah, 12V200Ah, 24V100Ah), UPS high-voltage lithium battery system ( Up to 860V), 3Kw~20Kw off-grid, grid-connected, island-type lithium battery energy storage system, base station communication backup battery system (standard 19 inches) and other products, we have a very stable customer base in the United States and Europe.

Although the United States has issued many preferential policies for lithium-ion energy storage systems, and the US government also hopes to establish a controllable and reliable local lithium-ion battery industry chain, things are not that simple. Let's analyze it in detail.

A: Energy storage systems: a core component of a clean grid

One of the most critical solutions to preventing further climate change is the decarbonisation of electricity. According to data released by the U.S. Energy Information Administration (EIA), in 2020, the power sector generated about 32% of total carbon emissions in the United States.

However, renewable energy suffers from intermittent power generation, which is significantly different from fossil fuel power generation facilities that can provide more power at any time. There are various solutions to address the intermittency problem and ensure that electricity demand is always met: renewable energy generation facilities, for example, can be overbuilt, however, this approach is costly and entails curtailment.

Another solution is to use a limited amount of controllable energy supplies (eg green hydrogen and nuclear power, etc.) during periods of insufficient sunshine or wind. But these emerging technologies still struggle to achieve viable cost and performance metrics.

While there are multiple approaches, energy storage is a very promising solution today and offers a wide range of design options. Among them, the lithium-ion energy storage system is a very good branch.

A battery is an electrochemical storage device that uses the energy difference between "redox" reactions to convert electrical energy to store electrical energy as chemical energy or from chemical energy. Batteries have many potential advantages over other forms of energy storage technologies.

Additionally, battery energy storage systems can be deployed almost anywhere, unlike thermal or gravity energy storage facilities that typically require a geographically specific storage location. These benefits allow batteries not only to be used for grid operations beyond decarbonization, but also to provide additional value as ancillary services; for example, batteries help improve energy independence and reliability.

Distributed microgrid designs composed of renewable energy generation facilities and energy storage systems can prevent catastrophic large-scale blackouts. This is because distributed generation reduces the construction and modification of transmission infrastructure (such as power lines and poles).

Additionally, distributed energy production eliminates the possibility of a single point of failure. Many countries do not possess large quantities of economically viable fossil fuel resources, so a shift to a renewable energy sector could boost domestic energy production and reduce the need for energy imports, thereby enhancing geopolitical freedom.

Lithium-ion batteries (LIBs) are considered the mainstream battery technology; in the 1990s and beyond, lithium-ion batteries were mainly used in electronics and mobile devices, and in recent years, lithium-ion batteries are mainly used in stationary energy storage systems and electric Automotive (EV) are two large-scale markets. Most of the battery technologies considered for the power industry are still relatively immature and may require extensive research.

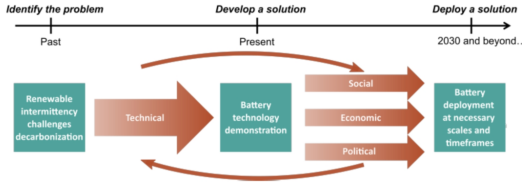

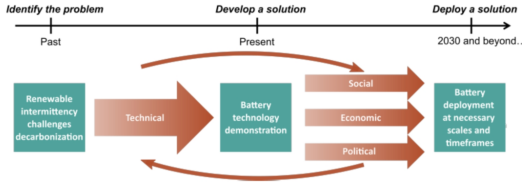

Figure: Schematic diagram of battery technology development and deployment process

B: Key Obstacle 1 Battery Cost

Cost is a central consideration in whether batteries can be used in grid energy storage applications.

Unlike other battery markets such as medical devices, consumer electronics, and electric vehicles, grid applications require much lower-cost clean energy solutions to compete with cheap fossil fuel power generation facilities.

Since grid deployment requires large-scale investments, often with access to financing (e.g. loans), capital costs have historically been a major barrier to renewable energy adoption and therefore a core indicator of their techno-economic viability. For batteries, the cost mainly depends on material cost and production scale. The U.S. Department of Energy typically caps the capital cost of an economically viable grid energy storage system between $100/kWh and $150/kWh.

Lithium-ion batteries are currently the most deployed battery energy storage technology in grid applications. Since the 1990s, lithium-ion batteries have been able to accelerate because of their first mass adoption in high-value markets including consumer electronics and electric vehicles. In these markets, battery manufacturers can sell less-optimized and higher-cost battery products because they are the only option.

This enables lithium-ion batteries to scale up and reduce costs while further optimizing performance. Therefore, when this technology is considered for energy storage systems, lithium-ion batteries already show strong performance, and the developed supply chain leads to lower costs.

Especially with the development of electric vehicles, the cost of lithium-ion batteries has fallen sharply over the past decade; lithium-ion batteries, including assembled battery cells and management and safety systems, have fallen to within the feasible range specified by the US Department of Energy (about 140 USD/kWh) and is expected to drop below $100/kWh in the future.

The global production capacity of lithium-ion batteries is estimated to exceed 700GWh per year and is today a nearly $50 billion industry. But supply chain issues could hinder the scale of deployment of lithium-ion battery storage systems.

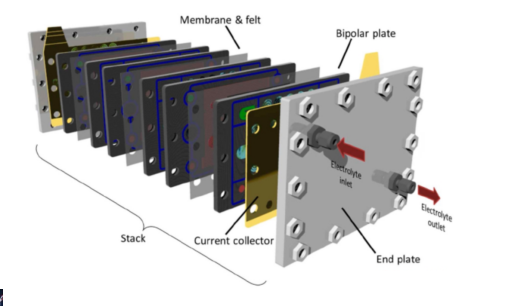

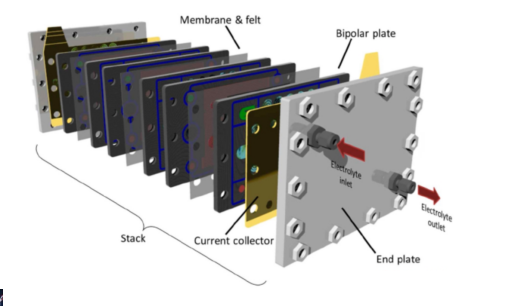

Cost reductions for some emerging energy storage technologies are encouraging. For example, redox flow batteries (RFBs) and metal-air batteries (MABs) appear to have steep cost curves relative to production scale. Both cells use an open "sandwich" type architecture that makes each individual reactor or "stack" component relatively simple in design and easier to assemble.

But redox flow battery (RFB) and metal-air battery (MAB) developers and producers are still small, although they share the same basic architecture and other related technologies (such as fuel cells and electrolyzers, etc.) Purchasing your own components in small batches keeps costs high.

Figure: Structure exploded view of redox flow battery (RFB)

For businesses, the ultimate option to overcome low initial volumes is to sell products at a loss because of the high cost of emerging technologies and lack of access to higher-value markets. Smaller companies often initially sell products at a loss, which is achieved through outside investment. While more investment is being made in clean energy technologies than ever before, the scale may not be able to meet the urgency required by key climate change deadlines.

C: Key Barrier 2 Material Restrictions

Batteries are material-intensive technologies, and they often rely on specific chemical elements that are selected for key properties, including their electrochemical properties, solubility, stability, and more.

Normally, as demand grows and the scarcity that comes with it, the price of the material will adjust to reflect the constraints. However, how to extract key materials and how quickly production can be scaled up can present difficulties. In addition, where the material is extracted and produced can present geopolitical issues. These challenges have proven to be particularly acute in the battery sector.

For example, cobalt is currently a key element in lithium-ion batteries. More than half of the world's reserves are located in the Democratic Republic of Congo, which also accounts for nearly 70% of global production. A similar situation exists in the vanadium supply chain, with 75% of production coming from 10 steel mills in China and Russia.

This concentration of production creates volatility in material supply and prices. In addition to these difficulties, both cobalt and vanadium are mined or produced primarily as by-products of other materials. This introduces supply chain complexity, as the scale of production of these materials depends primarily on the scale of production of other resources or products; in other words, the price or demand for cobalt and vanadium does not have a large impact on their supply, at least In the short term it is.

The lack of a diversified international supply chain for these critical battery materials complicates the situation. There are many examples of how geopolitical instability and external energy dependence can lead to supply shortages and price spikes, such as the Russian-Ukrainian conflict. Russia is the world's third-largest producer of natural gas, but the war has decimated its supplies. In addition, many countries have imposed sanctions or banned the import of natural gas from Russia. These factors have contributed in part to the surge in gas and oil prices, which is especially bad for Europe, where Russia supplies about 40% of its natural gas.

Given the instability that can result from this dependence, cobalt and vanadium, along with many other elements used in various battery technologies (e.g. lithium, platinum group metals, manganese, etc.), are declared by the United States as part of 35 "critical minerals" that are Minerals are vital to the national security and economic prosperity of the United States. So the U.S. government announced plans to support domestic production.

More recently, U.S. President Biden invoked the Defense Production Act, which is mandated by enabling the U.S. to prioritize the development of materials needed for national production. In this move, the bill was used to target domestic mineral production of key battery materials. However, these efforts are limited by a number of factors, primarily the geographic abundance of various minerals and the technical ability to mine them economically. In addition, many of the producers who have announced new plants in the US are not US-based, limiting the true depth of the domestic supply chain the US is building. Additionally, while these new projects have provided a plethora of new jobs, securing enough skilled workers to run factories has proven to be one of the most difficult hurdles.

Production growth rates, both domestic and global, may also limit battery deployment. Due to the surge in demand for lithium-ion batteries, the cobalt supply chain has been able to show rapid growth to meet global consumption that has tripled over the past decade. However, this rapid scale-up of production, especially in countries that may not be able to properly enforce it, could lead to other problems, especially given the environmental, health and safety concerns that mining typically entails. In Congo, there are concerns over the safety, compensation and mining of cobalt miners. In recent years, many vanadium mines have been closed due to environmental concerns, with a significant impact on supply and prices.

Lithium is an example of not scaling fast enough; after decades of falling prices, lithium-ion battery prices are starting to rise in 2021 due to a 400% rise in lithium prices due to lithium shortages.

The solution to this problem is to move away from batteries that rely on these expensive materials and centralized supply chains to low-cost, high-abundance chemistries. Also, battery recycling is important to reduce demand on the supply chain and material strength, although it won't help much in the short term, as most conventional batteries have a 20-year lifespan.

The recycling of closed systems such as lithium-ion batteries can be complex, especially when battery pack designs vary widely by manufacturer. Government departments can incentivize recycling by negotiating a large-scale purchase agreement with one or more suppliers of battery packs that meet recyclability standards.

D: Conclusion

With the right incentives in place, governments can help achieve and accelerate desired outcomes. In addition, no matter what method is adopted, time and market funds are required.