Bloomberg NEF: Global energy transition investment will grow by 27% in

2021, China will be the first again, the United States will be the second

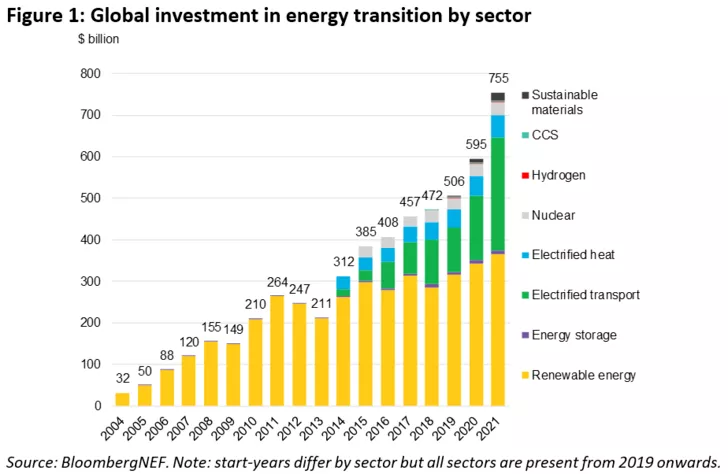

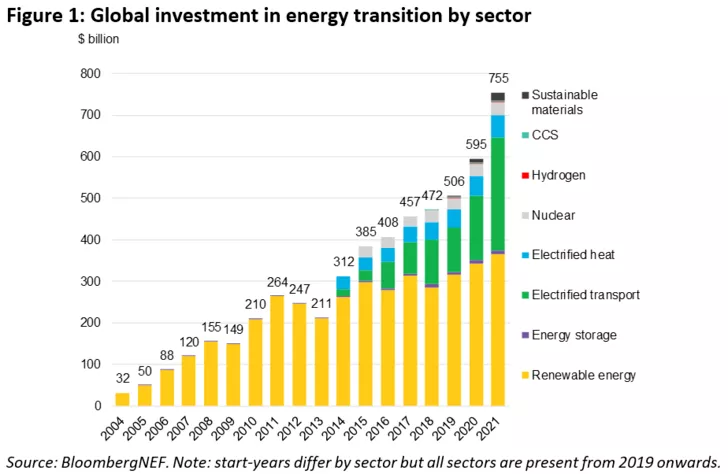

According to Bloomberg NEF (BNEF), global energy transition investment in

2021 will total $755 billion, a new record. Among them, renewable energy

achieved a new record of $366 billion in 2021, an increase of 6.5% over the

previous year.

Among regional investments, the Asia-Pacific region has both the largest

investment scale and the highest growth rate. China is again the largest single

country investing in the energy transition, with a commitment of $266 billion in

2021. The United States came in second with $114 billion.

SES Power believes that this is completely predictable. In order to achieve

carbon emission targets, many countries such as China and the United States have

begun to widely use the driving force of policies to drive social capital into

the renewable energy industry. This can be seen from the needs of SES Power's

customers. It can be seen that from the simplest lithium battery combination

more than ten years ago, to today, almost all customers need complex,

large-scale, one-stop service energy storage, power lithium battery products and

peripheral accessories.

Investments increased in nearly all sectors covered by the report,

including renewable energy, energy storage, electrified transport, electrified

heating, nuclear energy, hydrogen and sustainable materials. Renewable energy,

including wind, solar and other renewables, remained the largest sector for

investment, reaching a new record of $366 billion in 2021, a 6.5% increase from

the previous year. Electrified transportation, including electric vehicles and

related infrastructure spending, was the second largest component, with an

investment of $273 billion. With a surge in electric vehicle sales, the industry

will grow by 77% in 2021 and could surpass renewables in 2022.

Clean energy and electrification (including renewables, nuclear, energy

storage, electrified transport and electrified heat) together accounted for the

vast majority of investment at $731 billion. Hydrogen, carbon capture and

storage, and sustainable materials make up the rest, totaling $24 billion.

Albert Cheung, head of analysis at BloombergNEF, said: "The global

commodity crunch has created new challenges for the clean energy industry,

raising the cost of key technologies such as solar modules, wind turbines and

battery modules. Against this backdrop, the energy transition in 2021 The 27%

increase in investment is an encouraging sign that investors, governments and

businesses are more committed than ever to a low-carbon transition as part of

the solution to the current turmoil in energy markets.

All three regions covered by the report saw record investment amounts: Asia

Pacific (APAC), Europe, Middle East and Africa (EMEA) and the Americas (AMER).

Asia Pacific is both the region with the largest investment volume at $368

billion (almost half of the global total) and the region with the highest growth

rate in 2021 at 38%. In 2021, energy transition investment in EMEA increased by

16% to $236 billion, while investment in the Americas increased by 21% to $150

billion.

China is again the largest single country investing in the energy

transition, with a commitment of $266 billion in 2021. The United States came in

second with $114 billion (EU member states as a bloc committed $154 billion in

investment). Germany, the UK and France are among the top five for energy

transition investments in 2021. In terms of energy transition investment levels,

Asia-Pacific countries currently occupy 4 of the top 10, with India and South

Korea joining China and Japan.

BNEF's New Energy Outlook (NEO) 2021 maps three alternative scenarios

(called green, red and grey) that would enable net-zero global emissions by

2050, consistent with 1.75 degrees of global warming. Compared to NEO, today's

report shows that investment levels would need to roughly triple to achieve an

average of $2.1 trillion per year between 2022 and 2025 to achieve any of the

three scenarios outlined above. Then they need to double again, averaging $4.2

trillion between 2026 and 2030. At current growth rates, the electrified

transportation sector is most likely to reach this level of investment; it seems

unlikely that other sectors will reach this level.

Matthias Kimmel, head of energy economics at BNEF, said: “The world is

rapidly draining its carbon budget to meet the goals of the Paris Agreement. The

energy transition is well underway and faster than ever, but if we are to

achieve it by 2050 With net zero emissions, governments will need to raise more

money in the coming years.”

The report also found that total financing of climate technology companies

will reach $165 billion in 2021. The funds will be used to expand the companies'

operations and further develop their technologies in the coming years.

Two-thirds of that funding came from the public markets, including SPAC reverse

mergers, with the vast majority going to companies focused on the energy and

transportation sectors.

Claire Curry, Head of Technology and Innovation at BNEF, said: “Companies

have more money than ever before to tackle the toughest aspects of the climate

challenge. It is true that we have deployable solutions in place today, but

innovation still needs to continue. All forms of corporate financing will play

an important role in helping to develop and scale climate technologies over the

next decade.”

The setting of carbon emission targets is the cornerstone of the energy

transformation of all countries. SES Power laid out this plan as early as ten

years ago. We chose energy storage, power lithium batteries and peripheral

supporting facilities as breakthrough points, and replaced lead-acid batteries

as the primary starting point. Our 12V100Ah, 12V200Ah, 24V100Ah, 24V200Ah,

36V100Ah, 48V50Ah, 48V100Ah, etc. using square aluminum-shell lithium iron

phosphate cells, and 12V30Ah, 12V50Ah automotive starting batteries using

high-performance rate lithium battery A123 (maximum peak current can reach

1500A), These products can be applied to UPS, data centers, electric

motorcycles, golf carts, photovoltaic power generation and other fields.

Many customers attach great importance to cost performance, but SES Power

insists that safety performance cannot be reduced to reduce costs. We usually

use the price advantage of echelon batteries to make SES Power’s customized

lithium-ion battery packs on the basis of guaranteed performance. Customers who

are picky enough about price.