Several trends to watch in the energy storage market in 2022

In the foreseeable future, the energy storage market will usher in a new

round of explosive growth, which is caused by factors such as the increasing

demand for energy and the promotion of measures by governments to reduce carbon

emissions.

SES Power has nearly two decades of experience in lithium battery energy

storage products. We are very familiar with this market. We have launched

lithium iron phosphate batteries that replace lead-acid batteries, home energy

storage products similar to Tesla Powerwall, and customized lithium batteries.

Ion battery pack, etc. We predict that by the end of 2030, the energy storage

industry will have installed a cumulative 358 gigawatts (GW)/1,028 gigawatt

hours (GWh), breaking the 1 terawatt (TW) threshold, and 2022 is expected to

bring continuous growth, mainly from the following From one aspect.

A: The cost of battery energy storage continues to decline

In recent years, improvements in materials and manufacturing processes are

gradually driving down the cost of battery energy storage, making it more

cost-competitive with mainstream pumped storage technologies.

In battery energy storage projects, the investment cost accounts for about

69%. Among them, the cost of the battery pack accounts for the highest

proportion, reaching 55%, followed by the cost of BOS and EPC, 12%/10%

respectively, and the proportion of PCS 3%.

According to BloombergNEF data, the global average price of lithium-ion

battery packs in 2020 is about $137/kWh. By 2023, this price may drop to

$100/kWh, which is equivalent to an 89% drop since 2010.

B: There is a lot of room for improvement in industry policies

As the deployment of renewable energy expands, the energy storage system,

as the best partner, will play an active role in frequency regulation. Then, for

the growing energy storage market, its policy and regulatory space will

inevitably be further improved.

Taking the U.S. energy storage market as an example, in terms of policy, if

the U.S. continues to provide investment tax credits for independent energy

storage or optimize all aspects of energy storage policies and regulations, the

U.S. energy storage market will have a lot of room for growth in 2022. Secondly,

a good and orderly industry environment is also inseparable from the promotion

of policy supervision.

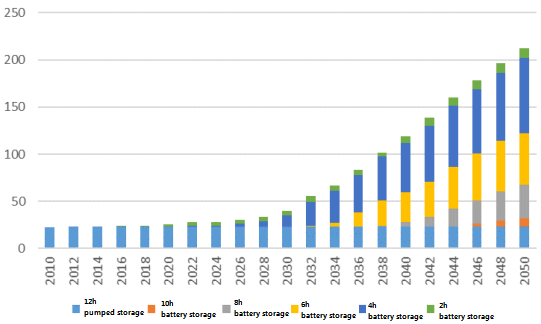

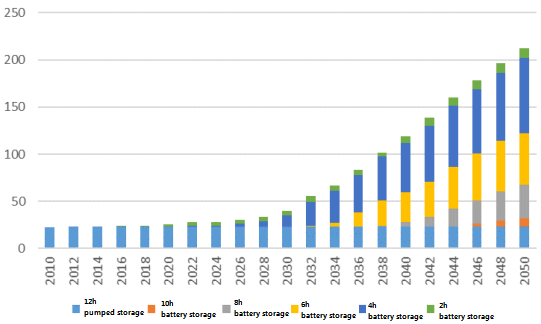

C: Long-term energy storage becomes more important

The world is promoting the "energy revolution", in which energy storage

plays an important role. Although the current global energy storage policy shows

a positive trend, people familiar with the energy storage industry know that the

biggest problem of energy storage is not only safety and cost, but also

timeliness.

Taking the U.S. energy storage market as an example, the average duration

of all energy storage systems has increased by more than 2 hours. At the same

time, there are more and more actual situations in which 4-hour energy storage

systems are combined with renewable energy. In the future, long-term energy

storage technology must be used as the mainstay of energy storage. Only by

conquering the direction can we truly realize the "energy revolution".

D: Labour shortages threaten continued growth

Under the trend of rapid growth of energy storage, there will inevitably be

a shortage of labor and a shortage of technical talents. Although the industry

currently provides employee training and universities offer professional

courses, it is still difficult to provide a large number of technical talents in

the short term.

In the face of a new industry, in addition to the difficulty of rapid

technological progress, there are also factors such as people's way of thinking,

training mode, organizational structure and so on. The energy revolution will

inevitably bring about various challenges, and how to promote industry talents

to build the cornerstone of industry progress is still particularly

important.

E: Unbalanced supply of raw materials will remain a challenge in the short

term

In the context of the high growth of new energy vehicles, the demand for

lithium-ion batteries has reached a record high. According to a recent report,

the global lithium-ion battery market is expected to grow from $41.1 billion in

2021 to $116.6 billion in 2030.

The continuous growth of electric vehicles will intensify the pressure on

raw material supply next year. Recently, it can be seen that major power battery

companies continue to expand their production capacity of raw materials, but

short-term pressure and imbalanced supply after expansion will be a major

problem faced by the industry.

This situation has led to a substantial increase in the price of lithium

batteries, and SES Power is also facing significant cost pressure. However, we

have in-depth cooperation with famous factories such as Yiwei Lithium Energy,

Ganfeng Lithium Industry, CATL, BYD, etc., and we can bear it for the time

being. price fluctuations. However, we have also launched energy storage systems

using echelon batteries according to market needs, such as 12V100Ah, 12V200Ah,

24V100Ah, 24V200Ah, 36V100Ah, 48V50Ah, 48V100Ah, etc., which use square

aluminum-shell lithium iron phosphate cells, which can meet the requirements of

guaranteeing performance. , the needs of customers who are discerning enough

about prices.

It is worth mentioning that the high growth of new energy vehicles also

brings opportunities for energy storage. Research shows that by 2050, electric

vehicles could increase energy use by 33% during periods of peak electricity

demand. Then, large-scale energy storage systems to relieve grid stress and

provide the necessary capacity for fast charging of electric vehicles are the

key to solving the problem.

F: comment at the end

As of 2020, the energy storage market share in the Asia-Pacific region

exceeds 45.0%. As major economies such as China and India continue to grow and

renewable energy expands, so does the need for reliable electricity. Based on

the trend of distributed growth, it is predicted to drive the market growth in

the short term.

Second, improved energy storage technology could allow electricity

providers to save excess electricity for later use, thereby increasing the

reliability and flexibility of the grid in terms of generation, transmission and

distribution. Short-term and seasonal energy storage systems, then, will help

balance power distribution with economic benefits.

In addition, the demand for continuous power will grow exponentially in the

coming years due to industrialization, infrastructure, and workforce

development, a trend that will positively impact the energy storage industry

landscape.

This is an industry full of opportunities in the future, and SES Power

looks forward to working with you to seize the opportunities.