The new energy market in the U.S. is growing at a rapid pace, mainly due to real needs and government stimulus. As the world's largest economy, the U.S. has strong spending power and a high level of acceptance of new technologies. SES Power has a number of important customers located in the U.S., so we know a lot about the new energy situation in the U.S. Let us sort out the recent new energy developments in the U.S. for you.

A: Installed capacity, financing and M&A in the U.S. energy storage market in the first nine months of this year

The installed capacity of battery energy storage systems deployed in the U.S. has more than tripled since the beginning of 2021, reaching 6,702 MW, according to a survey released Oct. 12 by Austin, Texas-based research firm Zpryme Inc.

According to data released by the company, the installed capacity of energy storage systems planned for future deployment in the U.S. will increase by 35% to 2,678 MW.

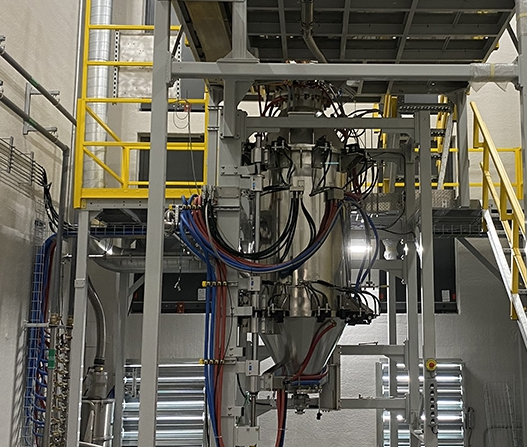

(Containerized battery energy storage system rendering)

The top five states in the United States in terms of installed capacity of battery energy storage systems deployed in August were: California, 3629MW; Texas, 1168MW; Florida, 520MW; Massachusetts, 196MW; and Nevada, 165MW.

According to the survey, the installed capacity of battery storage systems deployed in the U.S. has more than tripled since the beginning of 2021, with nearly 6GW of new storage systems planned for deployment in August.

The report notes that the U.S. added 10 new operational battery storage projects in August, with 415 MW of installed capacity, and that the cumulative installed capacity of battery storage systems opened in August increased by 6.6% compared to July; as of August, 376 battery storage projects were in operation in the U.S. Independent power producers own about 81% of the installed battery storage system capacity, and utilities own 19%.

Installed capacity of energy storage systems planned for deployment in August added 5,879 MW, the largest increase in 19 months since January 2021. From 1,631 MW in January 2021 to 415 MW in August this year, the installed capacity of battery energy storage operating in the United States has increased by 311%.

The survey claims that in August, the top five battery storage project owners by installed capacity were NextEra Energy with 1,295MW, Terra-Gen5 with 547MW, LS Power with 450MW, Broad Reach Power with 339MW, and AES Corp. with 327 MW.

In response to the deployment of clean energy requirements and the recent passage of the Inflation Reduction Act, the U.S. is preparing for large-scale deployment of energy storage systems. According to BloombergNEF forecasts, this act is expected to drive the development and deployment of an additional 30GW/111GWh of battery energy storage systems between 2022 and 2030.

From another perspective, the installed capacity of energy storage systems deployed in the U.S. is growing. According to a study by Mercom Capital Group, corporate financing for energy storage developers and integrators soared in the first nine months of 2022, with 92 deals raising $22 billion, compared to 74 deals raising $13 billion in the same period last year. In the first nine months of the year, however, venture capital funding for energy storage developers and integrators fell to $4 billion in 73 deals, compared to $7.2 billion in 60 deals last year.

In addition, the U.S. energy storage industry completed 23 M&A deals in the first nine months of 2022, an increase of eight compared to the same period last year.

B: The U.S. government plans to provide more than $7 billion in funding for battery supply chain R&D, manufacturing and recycling

The U.S. government has announced that it will provide a total of $2.8 billion in grants that will be used to support and develop the domestic production of batteries for the electric vehicle (EV) and energy storage systems chain.

The first grants announced recently will be awarded to 20 manufacturing and processing companies in 12 U.S. states, selected from a competitive pool of more than 200 applicants.

President Joe Biden spoke in a speech about the release of the "Restore America's Manufacturing and Industrial Future: Semiconductors and Clean Energy" industrial strategy.

A key part of the strategy is to invest more than $7 billion in the battery supply chain to improve U.S. processing, manufacturing and recycling capabilities for key minerals such as lithium, nickel and graphite.

Biden claims that the first $2.8 billion in funding will more than triple the economic benefits they will help bring to battery production and processing facilities. At the same time, Biden launched the U.S. Battery Materials Initiative, which aims to work through the U.S. government and in partnership with private and public sector organizations, labor unions, diverse communities and foreign governments.

It will be led by the U.S. government, managed by the U.S. Department of Energy and supported by the U.S. Department of the Interior in the use and development of the battery materials supply chain. Biden noted that this will help secure the U.S. electric vehicle battery supply chain and a clean energy future.

Recent optimism in the U.S. energy storage industry has been buoyed by the passage of the Inflation Reduction Act, which would provide $369 billion in tax credit incentives for independently deployed energy storage projects to support clean energy and distributed energy development.

These funds will flow to a number of companies in the upstream battery industry. It combines the scale-up of existing mature technologies in the U.S. (such as cathodes for lithium iron phosphate and graphite anodes, which are currently almost entirely imported) with R&D funding for more innovative technologies (such as silicon anodes and advanced battery production technologies) in the early stages of commercialization.

In addition, a number of raw material production projects will be supported, with lithium extraction being an area of urgent interest to the global battery industry.

C: 4,367 MW of battery storage systems have been integrated into the California grid

California's SDG&E recently completed the deployment of a 40MW battery storage system and began construction of four microgrids built with 39MW storage systems.

The company announced on Oct. 12 that it has begun testing a 40MW storage project deployed in the Fallbrook area between San Diego and Los Angeles, and has begun construction of one of four microgrid projects. The company currently has 95 MW of energy storage assets and another 200 MW of energy storage systems under development.

(SDG&E executives at Fallbrook battery storage system groundbreaking ceremony)

The Fallbrook battery storage system is sized for 40MW/160MWh with a 4-hour duration as a condition of providing power to utilities (such as SDG&E) when resources are available and the California Independent System Operator (CAISO) means to ensure sufficient supply to meet power demand. Once testing is complete, the battery storage project will enter the state's energy market.

The Elliott microgrid in San Diego is the first of four microgrids being built that will be able to provide electricity to a number of local communities, said Miguel Romero, vice president of energy innovation at SDG&E: "Innovative technologies like energy storage systems and microgrids are critical to building a more resilient grid that can renewable energy availability through periods of peak electricity demand."

The latest data from the California Independent System Operator (CAISO) indicates that it has 4,367 MW of battery storage systems connected to the grid as of Oct. 1, 2022.

Large battery storage projects that have recently been completed and connected to the grid include a 908MWh battery storage system from AES, a 387MW battery storage system from NextEra, and a 200MW co-located deployed battery storage system from EDF.

As a manufacturer with nearly 20 years of experience in the lithium battery industry, SES Power has focused on the product needs of lithium battery energy storage systems for a long time, and we have introduced corresponding products for different application scenarios to achieve the best cost performance, such as lead-acid replacement products with balanced performance of square aluminum-cased lithium iron phosphate batteries (12V100Ah, 12V200Ah, 24V100Ah, etc.), and large battery storage systems. 24V100Ah, etc.), high-current (2000A) startup lithium battery, UPS high-voltage lithium battery system (up to 860V), 3Kw~20Kw off-grid, grid-connected, islanded lithium battery energy storage system, wall-mounted home energy storage system 48V100Ah, 48V200Ah, stacked energy storage system (single 51.2V100Ah, supporting up to 15 stacking), etc.

If you have any questions about lithium batteries, you are welcome to contact us.