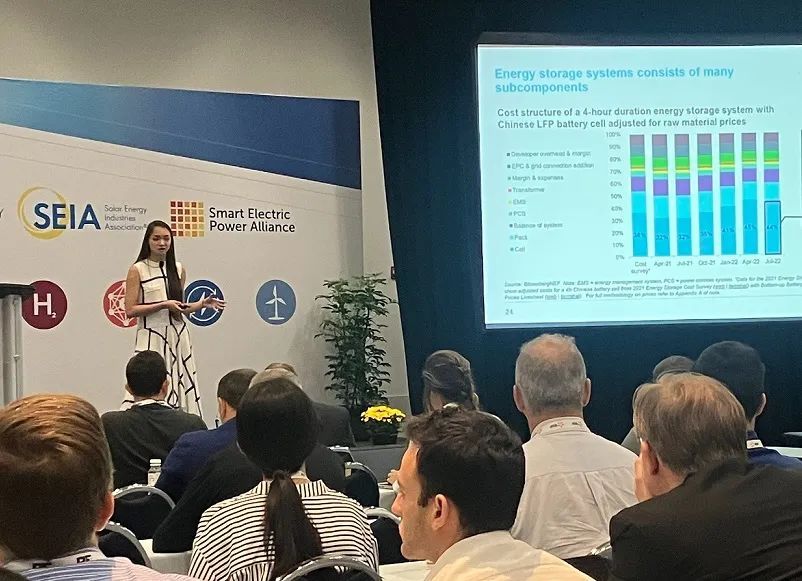

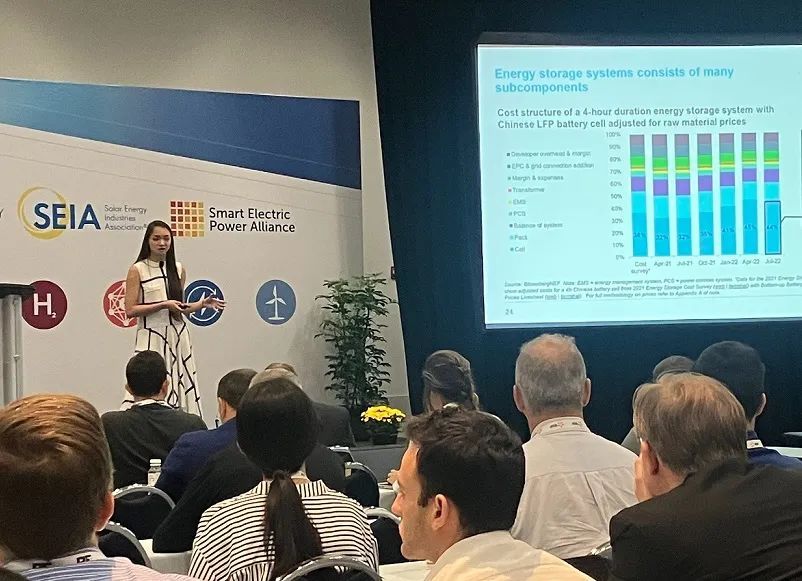

At the International Battery Energy Storage Alliance's RE+ 2022 industry conference workshop in California, BNEF energy storage analyst Helen Kou said supply chain issues may mean a 29 percent reduction in expected development in the United States.

(BloombergNEF energy storage analyst Helen Kou speaking at the RE+ 2022 IBESA workshop)

A: Transportation, raw materials are constraints

Kou said the company's upcoming annual battery pricing report indicates that these constraints are also the main drivers of "significantly higher" prices along the value chain this year compared to 2021. Significant price increases are occurring as customer demand for battery storage continues to grow.

In presenting some of BNEF's key findings, Kou said, "I think this industry is at a very critical time. The demand is actually clear and a lot of utilities want to put batteries in their grids for firming up their renewable generation systems, but in reality, the supply is quite uncertain."

The reasons for these problems are well documented and include logistical bottlenecks from COVID-19 and the rising price of raw materials for lithium batteries.

Early industry sources noted that components and systems for some battery storage projects were shipped as early as April 2020, weeks before the outbreak, but were stuck in container queues at ports like the Port of Los Angeles (at the peak of the outbreak, there were an average of 84 ships per day waiting to unload).

Due to congestion and logistical constraints, these components and systems are still not on the grid today in 2022. However, BNEF believes that while the logistics situation has remained challenging for some time, it is now showing some signs of easing.

In the long run, volatility in raw material prices will remain a long-term issue, at least until the end of the century, when more lithium capacity comes on stream.

B: Cost, "a controversial issue"

All of the components that make up the various subsystems of a complete energy storage system have experienced inflation-induced cost increases and labor cost increases over the past few months, but battery costs have risen most dramatically.

"This is really important because batteries are the largest cost component of an energy storage system, and the cathode is the most costly part of the battery."

The cathode material uses lithium carbonate, cobalt sulfate and nickel sulfate, which have been affected by the supply chain, international situation and other influences that have seen prices rise sharply in a very short period of time, which has affected the entire industry. While supply constraints for the latter two have eased, lithium iron phosphate (LFP) batteries are becoming increasingly popular in both the electric vehicle sector and battery storage, which BNEF predicts means lithium carbonate prices "will remain high for some time."

Analysts are often asked the "rather controversial question" of whether battery manufacturers are inflating costs above levels commensurate with commodity price increases.

"After extensive analysis, we have concluded that this is not the case."

There are clearly two main reasons for this.

First, pricing varies widely, depending on the manufacturer's size and corporate strategy, Kou said, noting that Korean manufacturers SK Innovation, LG Energy Solution and Samsung recorded vastly different cost figures in their quarterly filings.

Another reason is that the so-called "production premium" declines over time.

Based on the spot market prices of materials used for LFP and nickel-manganese-cobalt (NMC), BNEF can calculate the value of these premiums added by manufacturers.

In 2020, the production premium for materials averages about 2.8 times, meaning that it costs about $10,000 per kilogram of LFP material to manufacture, but the price per kilogram at that time is about $28,000. As of July 2022, this premium has fallen to 1.3 times.

BNEF's revision of its forecast is largely in line with that of rival Wood Mackenzie Power & Renewables. The latter recently said that in 2022, U.S. deployments could be 30% lower than previously expected.

In addition to supply chain challenges for energy storage, Wood Mackenzie noted that the uncertainty surrounding the prospect of tariffs on imported solar modules has caused companies in the solar-storage space to put some investment decisions on hold.

However, Wood Mackenzie believes that despite these challenges, total development could reach 13.5 GWh this year and could exceed 50 GWh after this decade. as BloombergNEF's Helen Kou acknowledges, it is clear that demand for energy storage remains, even with the challenges of logistics and pricing dynamics.

C: Demand will always drive production

Even now we still don't see a reason for raw material prices to fall, but demand has always been where it is, and it is increasing expressly.

Strong demand will definitely drive the expansion of production, this is the simplest truth. Although lithium resources are rare, they are not so scarce that SES Power believes that this situation will gradually improve with the gradual normalization and expansion of raw materials and logistics input, and the price will certainly correspond to the corresponding value.

As a professional manufacturer with nearly two decades of research and development and manufacturing of lithium battery energy storage systems, SES Power's products are made of high-quality lithium iron phosphate batteries, such as lead-acid alternatives with Bluetooth or RS485 communication (lithium iron phosphate 12V100Ah, 12V200Ah, 24V100Ah), high-current (2000A) starter lithium batteries, UPS high-voltage lithium battery system (up to 860V), 3Kw~20Kw off-grid, grid-connected, islanded lithium battery energy storage system, wall-mounted form of home energy storage system 48V100Ah, 48V200Ah, stacked energy storage system (single unit of 51.2V100Ah, supporting up to 15 stacks), etc.

We are confident in the development of the energy storage industry and the future, if you have any questions about lithium batteries, you are welcome to contact us.