Although lithium-ion batteries and surrounding industries have been

affected by the global economy, the Russian-Ukrainian conflict, and the

epidemic, the supply chain has been blocked and prices have soared, but many

energy storage projects have not stopped. As a professional lithium battery

energy storage system integrator, SES Power has nearly 20 years of experience in

the lithium-ion industry. Our products have high technical content, such as

fully intelligent lead-acid replacement products (12V100Ah, 12V200Ah),

high-current (2000A) starting lithium batteries, UPS high-voltage lithium

batteries Battery system (up to 860V), 3Kw~20Kw off-grid lithium battery energy

storage system, base station communication backup battery system (standard 19

inches), etc. We are always paying attention to the development of the energy

storage industry. Let us sort out the recent developments in energy storage for

you.

A: New Leaf Energy plans to deploy a 7GW/28GWh battery energy storage

system

US solar and energy storage developer Borrego has announced that it has

completed the spin-off of its business units and sold its energy development

business to energy transition investor ECP, which will be renamed New Leaf

Energy.

(Borrego's 96MW Borrego Solar Farm for ES)

New Leaf Energy is run by ECP as an independent business and the current

leadership team will be retained. Borrego said the sale could reduce the funding

constraints faced by the research and development division.

New Leaf Energy will plan to deploy 450 projects, including a total

installed capacity of more than 8.5GW of solar power generation facilities and

7GW/28GWh of battery energy storage systems, after the sale to ECP, they will

continue to focus on distributed generation (DG) and Development and deployment

of utility-scale solar power facilities and energy storage systems.

Borrego said New Leaf Energy will seek to strengthen its presence in core

markets such as New York, Massachusetts, Maine, Virginia, Pennsylvania, Delaware

and Illinois, with plans to enter states including California, New markets

including Arizona and Colorado.

B: Still accelerating, 5GWh of battery energy storage systems deployed in

the US in the first half of 2022

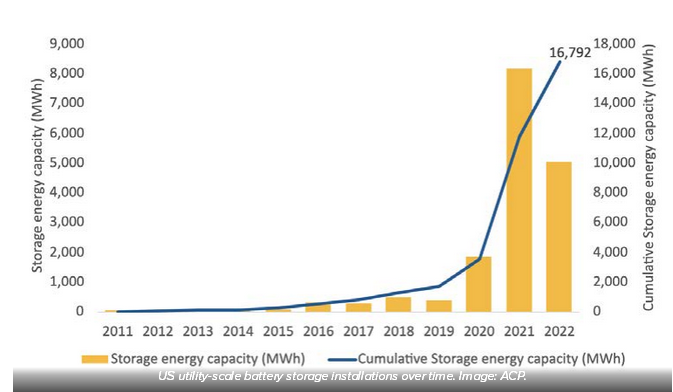

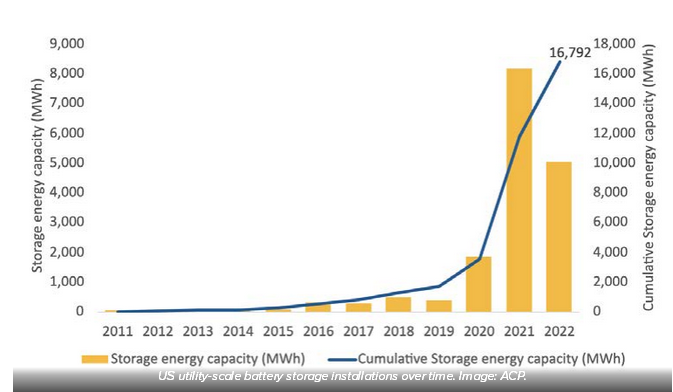

According to survey data recently released by the American Clean Energy

Council (ACP), the United States deployed about 5GWh of battery energy storage

systems in the first half of 2022, an increase of one-third compared with the

same period last year, while the deployment of wind and solar power generation

facilities The installed capacity has dropped by 50% to 70%.

In the quarterly report, the United States deployed 14 new battery storage

projects in the second quarter, totaling 992MW/2,468MWh, an increase of 13%

compared to the same period last year.

(Battery energy storage systems deployed in the United States from 2011 to

2022)

The US installed 758MW/2,537MWh of battery storage systems in the first

quarter, a 173% increase compared to the same period last year. According to the

survey data of research firm Wood Mackenzie, the storage capacity of battery

energy storage systems installed in the United States in the first quarter was

slightly lower, at 2,339MWh.

This means that a total of 1,751MW/5,015MWh of battery storage systems were

deployed in the US in the first half of this year. The American Clean Energy

Council (ACP) doesn't say it's a year-over-year increase, but using the two

quarters data shows that storage deployments have grown by about a third.

The largest battery storage project installed in the US in the second

quarter was Vistra's DeCordova battery storage system in Texas at 260MW/260MWh.

The largest energy storage capacity is an 800MWh Diablo battery energy storage

system developed by LS Power in California.

As of the end of June, the cumulative installed capacity of battery energy

storage systems in the United States was 6,471MW, with a total energy storage

capacity of 16,792MWh.

Despite the growth in both quarters, more than 1GW of battery storage was

deployed in the fourth quarter of 2021 in the strongest quarter on record,

according to the annual report released by the American Clean Energy Council

(ACP).

Despite an increase in battery storage deployments in the first half of the

year, clean energy deployments overall fell 25%, the largest drop in six months

since 2018, the American Clean Energy Council (ACP) said.

The decline in clean energy capacity deployed in the second quarter of this

year was even greater, falling by 55%. The battery energy storage sector was the

only sector to grow, accounting for 31% of the 3,188MW of clean energy

installations installed during the same period. The installed capacity of wind

power generation facilities decreased by 78% year-on-year, and the installed

capacity of solar power generation facilities decreased by 53% year-on-year.

This is partly due to supply chain constraints and grid connection issues

that have delayed projects. According to the American Clean Energy Council

(ACP), there are now 32GW of clean energy projects delayed, of which 64% are

solar, 13% battery storage and 23% wind.

C: ArcLight acquires 80MWh battery energy storage project

ArcLight Capital Partners said a few days ago that it has acquired a 185MW

wind farm and an 80MW battery energy storage system (BESS) hybrid deployment

project from GlidePath Power Solutions.

In addition to investing in the acquisition of wind farms, Sequitur

Renewables (a subsidiary of ArcLight) was awarded the opportunity to develop and

deploy an 80MWh battery energy storage system, described as an "ancillary"

project to the wind portfolio, but not No details were provided on the expected

completion date of the energy storage system or whether it would be co-located

with wind power.

Usually, the installed capacity of wind power projects is much higher than

that of battery energy storage systems, and wind power generation is highly

variable. If the battery energy system is deployed in co-location, more

batteries need to be deployed, and frequent charging and discharging will

shorten the time. battery life, so co-location of battery storage systems with

wind power generation facilities is not as common as co-location with solar

power generation facilities.

Carter Ward, Partner at ArcLight, said: "We are delighted to re-enter the

wind power market with the establishment of the Sequitur platform."

Sequitur Renewables, which recently announced progress with other

large-scale battery-storage-related developments, said conventional thermal

power plant sites are the best places to deploy these portfolios. As efficient

scaling is one of the main challenges for battery energy storage projects, it is

advantageous to leverage the existing interconnection and on-site infrastructure

of large power plants.

For example, Generation Bridge recently completed a study for its 335MWh

Long Beach PierS battery storage project in Long Beach, California. And plans by

Eastern Generation to deploy the 540MWh LuysterCreek battery storage project in

New York State recently won New York regulatory approval.

Dan Revers, managing partner at ArcLight, added, "Sequitur leveraged

ArcLight's core expertise in power generation, renewables and energy transition

in acquiring and developing battery storage systems."

D: The financing of the US energy storage industry is accelerating

U.S. clean energy project developer and independent power producer (IPP)

Broad Reach Power said it has secured $160 million in financing to invest in and

deploy a portfolio of 18 battery energy storage system (BESS) projects.

Of the 390MWh of battery storage systems planned or being deployed, 17 are

located in Texas and one in California, two markets where Broad Reach Power is

primarily active. The energy storage systems are all grid-side grid-scale energy

storage systems using lithium-ion batteries, which the company says come from a

variety of manufacturers.

Deutsche Bank, through its New York branch and Mitsubishi UFJ Financial

Group (MUFG), acted as coordinating lead arranger and joint bookrunners in the

round. Nitin Gupta, senior vice president of financing and mergers and

acquisitions at Broad Reach Power, described the financing as a major debt

financing transaction in the battery energy storage space.

They were followed in terms of financing by energy storage system

integrator FlexGen, which raised $100 million, Dutch energy trader Vitol and

another systems integrator Powin Energy, which raised $135 million.

Interestingly, Josh Prueher, CFO of Broach Reach Power, is the founder and

former CEO of FlexGen, and Doug Moorhead, CTO of Broad Reach Power, was CTO and

president of FlexGen.

Other major recent funding moves in the U.S. energy storage industry

include Norwegian state-owned energy developer Equinor and U.S. sustainable

infrastructure investment group Generate Capital acquiring energy storage

developers EastPoint Energy and esVolta, respectively, for undisclosed sums.

Industry media reported in June 2020 that Broad Reach Power began deploying

a 10MW/10MWh battery storage system in Texas. The company said at the time that

it was also developing two 100MW/100MWh battery storage systems in the state to

participate in the Electric Reliability Commission of Texas (ERCOT) wholesale

market. The company quickly made good on that promise, starting construction of

the two 100MW/100MWh battery storage systems in September of that year, and

starting operations more than a year later.

The company expanded into California in November 2020 with the acquisition

of a 100MWh battery energy storage project from Enel, while its publicly

announced supplier agreements include a 118MWh supply agreement with SYL Battery

for its California project, and an agreement with CATL for Its Texas battery

energy storage project has an agreement to supply 900MWh batteries.

Broad Reach Power was valued at more than $600 million late last year after

Apollo Funds, an affiliate of asset management group Apollo, bought a 50 percent

stake in the company. Apollo Funds is also an investor in FlexGen.