Analysis Report (1): Cost and Value of Hybrid Energy Storage Projects in

the United States

The rapid deployment of wind and solar power projects is one of the most

important power system trends of the 2010s, and survey data suggest that a

tipping point in the 2020s may be the rapid deployment of "hybrid" deployment

projects.

SES Power has nearly 20 years of experience in the customized lithium

battery industry. We use EVE, CATL, BYD square aluminum lithium iron phosphate

batteries to develop and produce 12V100Ah, 24V100Ah, 36V100Ah, 48V100Ah, 60V100,

and 3KW home energy storage. , 5KW system, rack-mounted energy storage system

and other products. Almost all of these products are standardized and

modularized. They integrate RS485, CAN and other communication protocols to

support remote monitoring and operation. At the same time, AI intelligent

analysis and cloud storage are added to the new generation of systems, which can

ensure system compatibility, high speed and reliability. In the energy storage

industry, the United States is one of the most promising places in the world,

and we have compiled the following information about hybrid energy storage

projects in the United States for you.

Hybrid deployments typically co-locate solar power projects or wind power

projects (or other energy sources) with battery storage systems. Just as falling

costs have driven rapid growth in solar and wind projects over the past decade,

falling battery prices and the growing need to integrate renewable energy

generation are driving plans to deploy hybrid projects. While hybrid deployments

can help alleviate the challenge of balancing intermittent supply from

renewables, their relative novelty means that research is needed to foster

integration and innovation.

Combining energy storage and conversion technologies and the

characteristics of multiple renewable energy sources creates complex issues for

grid operations and costs. And project developers, system operators, planners

and regulators need to estimate the cost, value and system impact of hybrid

projects in order to benefit from better data, methodologies and tools.

Opportunities to deploy hybrid deployments are increasing as the power system

moves towards more renewable power, but their impact and optimal application

have yet to be determined.

The Lawrence Berkeley Laboratory (Berkeley Lab) recently released a

research report titled "Top Ten Findings from the Renewable Energy Research

Project". The report analyzes where and why hybrid deployments are built, models

optimal hybrid design choices, and assesses hybrid deployments' contribution to

resource adequacy and short-term supply reliability.

How to define a hybrid hybrid deployment project?

• Combination of power generation facilities and battery storage

systems.

• Operates as one or two independent generating units.

• Co-located.

Top 10 findings of the Renewable Energy Research Project:

(1) Growth

Interest in hybrid deployment projects is strong and growing among

renewable energy developers.

(2) Price VS Value

Solar + energy storage projects have low power purchase prices but high

value in some regions.

(3) Market driving factors

Solar-plus-storage projects are driven by tax credits and other

incentives.

(4) Configuration selection

Market prices have incentivized solar power facilities to deploy short-term

battery storage systems.

(5) Capacity value

The capacity contribution of a hybrid deployment project is less than the

sum of its parts.

(6) Ancillary services

The ancillary services market is a valuable but short-lived option for

hybrid deployment projects.

(7) Market participation

Hybrid deployment projects can participate more flexibly in the electricity

market.

(8) Operation

The power system value of hybrid deployment project systems depends on how

they operate.

(9) Distributed hybrid deployment project

The growth of solar-plus-storage projects at customer sites presents new

opportunities.

(10) Future Research

How will the future develop? A priority area of research for hybrid

deployment projects.

a. to grow

(1) Strong and growing interest from renewable energy developers in hybrid

deployment projects

Falling battery prices and demand for renewable energy generation have

driven interest in hybrid deployment projects. Current developer interest is

focused on deploying solar power generation facilities with battery energy

storage systems, but energy storage systems can be deployed with a variety of

renewable energy generation facilities.

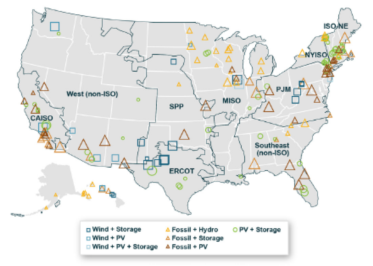

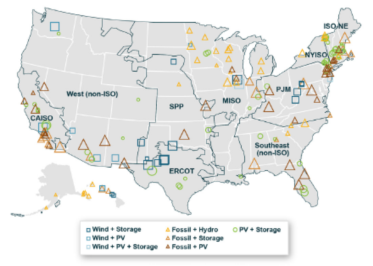

(2) By the end of 2021, the number of solar + energy storage projects or

wind power + energy storage projects already connected to the grid in the United

States has exceeded 8GW

Solar+storage projects dominate the total installed capacity of hybrid

deployments with more than 5.9GW of installed capacity, while wind+storage

projects are only 2GW and solar+wind+storage projects are only 750MW. And this

market has already started to grow exponentially, with a 133% increase in the

cumulative installed capacity of operational hybrid deployment projects in 2021

compared to the cumulative installed capacity deployed at the end of 2020.

Although there are many hybrid deployment projects of fossil energy + energy

storage, the total installed capacity is relatively small.

(Location of existing hybrid deployment projects in the U.S. by 2020)

(3) Plans for planned deployment indicate growing interest in hybrid

deployment projects of renewable energy and energy storage systems

Data from energy projects under development in interconnected cohorts of

seven wholesale markets and 35 utilities in the U.S. suggest that renewable

energy developers have considerable commercial interest in hybrid deployment

projects.

By the end of 2021, the installed capacity of solar power generation

facilities planned to be deployed in the United States exceeds 675GW, of which

286GW (about 42%) are proposed as hybrid deployment projects, the most common

deployment of solar power generation facilities and energy storage systems.

There are also plans to deploy 247GW of wind power facilities, of which 19GW

(about 8%) are proposed as hybrid deployment projects, which are also usually

deployed with wind power facilities and energy storage systems.

While many of these proposed projects will ultimately fail to achieve

commercial operations, strong interest in deploying hybrid deployments bodes

well for strong capacity growth. This is especially true in the California

Independent System Operator (CAISO) service area, where 95 percent of solar and

42 percent of wind facilities are proposed for hybrid deployments.

Figure 2. The installed capacity of hybrid deployment projects planned for

deployment in the United States in 2021

B. Price vs Value

(1) The power purchase price of solar + energy storage projects in some

areas is low but the value is high

While the number of hybrid deployments currently operating in the U.S. is

still small (but growing), it is possible to gain insight into the configuration

and pricing of upcoming hybrid deployments by looking at power purchase

agreements (PPAs), which are often the project was implemented several years

before it was put into operation.

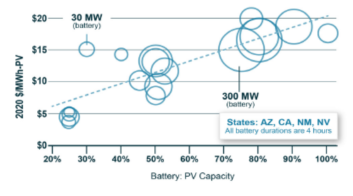

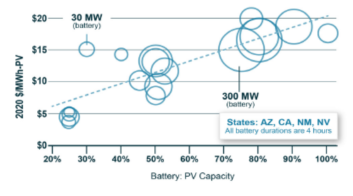

(2) The electricity purchase price of solar + energy storage projects will

gradually decrease

In the price sample, the price (USD/MWh) of a hybrid solar+storage

deployment project (shown in the figure below as an open circle reflecting the

installed capacity ratio of battery storage systems to solar power generation

facilities) is close to the price of independently deployed solar power

generation facilities (smaller filled circle).

As a result, solar-plus-storage projects will become more common over time.

And in Hawaii (orange), almost every utility-scale solar facility that signed a

power purchase agreement (PPA) after 2017 was equipped with battery storage, and

the balance appears to be in the other four states shown (blue) changed. These

power purchase agreement (PPA) levelized prices reflect the US federal

Investment Tax Credit (ITC) incentives.

(3) The power purchase agreement (PPA) premium of the hybrid deployment

project reflects the scale of its battery storage system

A subsample of 17 power purchase agreements (PPAs) separates the price of

each component of a solar-plus-storage project, enabling an accurate calculation

of how much power purchase agreement (PPA) prices for storage systems have

increased.

The ratio of battery to solar capacity increases linearly (above), which is

one of several reasons why hybrid deployments in Hawaii (all batteries are

relatively large) are more expensive than other states in the graph one.

(4) Hybrid deployment projects are almost always net worth

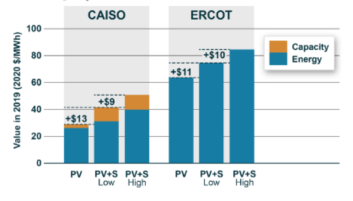

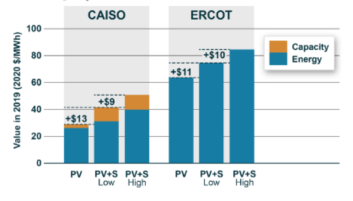

Berkeley Lab modeled the value of California Independent System Operators

(CAISO) and Electric Reliability Commission of Texas (ERCOT) independently

deployed solar power facilities supporting battery energy storage systems with

an installed capacity of 50% for solar power facilities. Half of the installed

capacity for a duration of 4 hours (as shown in the picture below).

This configuration should increase power purchase agreement (PPA) prices by

$8-$13/MWh. Of course, the value of a hybrid deployment project will vary over

the life of a power purchase agreement (PPA), but at least in recent years, and

with the help of the federal Investment Tax Credit (ITC), the added value

appears to be Justify the price premium.

C. Market Drivers

(1) Solar+storage projects are driven by tax credits and other

incentives

Hybrid deployments and co-located renewable energy facilities and battery

storage systems can benefit from tax credits, construction cost savings, and

more flexible generation facility scheduling, but are subject to site selection

constraints.

(2) Access to investment tax credits is a major reason for promoting hybrid

deployments

Co-locating solar and battery storage is required to make battery storage

eligible for federal investment tax credits, save on shared facility and

interconnection and permitting costs, reduce solar curtailment, and facilitate

energy transfer. In addition, renewable energy generation facilities deployed in

conjunction with battery energy storage systems have greater dispatch

flexibility, making them more attractive for grid operations.

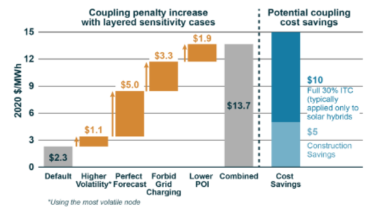

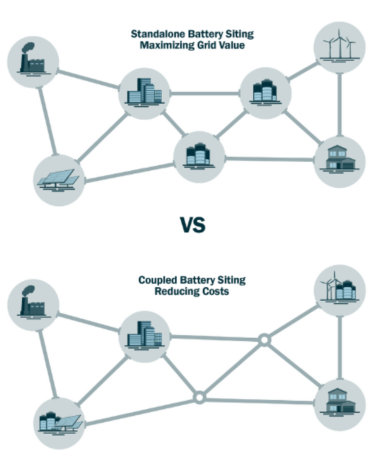

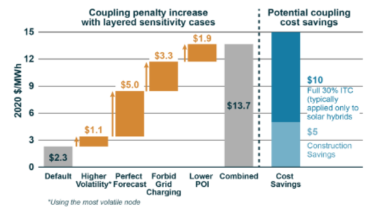

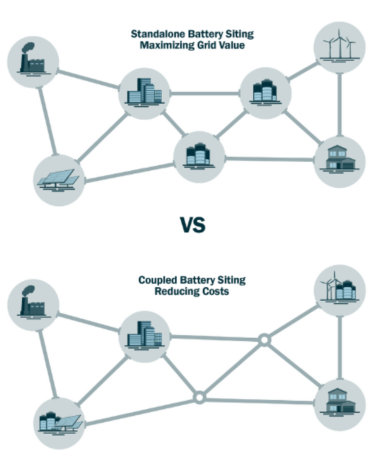

(3) The location of deployment may not be where the energy storage system

provides the greatest benefit to the grid

Large-scale wind power projects and solar power projects are usually

deployed in places with abundant power generation resources, vast land and can

be connected to the grid. And battery storage systems can be deployed almost

anywhere, such as high-value locations that can provide additional value to the

local grid, such as alleviating grid congestion and mitigating price volatility.

The study found that, depending on the region and year, the market value of a

separate deployment of renewable energy generation and battery storage is $2 to

$9/MWh higher than a hybrid deployment. Across seven wholesale markets in the

US, this “coupling loss” averages $2/MWh (as shown in the chart below).

(4) The higher costs of deploying projects independently are largely offset

by the cost savings of hybrid deployments

A rough cost savings of $15/MWh was calculated in the study, with $10 from

the 30% investment tax credit (ITC) earned and $5 from construction cost

savings—both above the default coupling loss. However, if the battery storage

system is only charged from co-located renewable energy generation facilities,

if the interconnection capacity is limited by the size of the renewable energy

generation facilities, and the storage system dispatch can operate with perfect

predictability, then the coupling Losses could increase to $14/MWh.

Uncertainty about coupling losses and cost savings for hybrid deployment

projects shows that development models for both independent and hybrid

deployment projects are feasible.

(Site selection for independent deployment of battery energy storage

systems vs. site selection for co-location deployment of battery energy storage

systems)

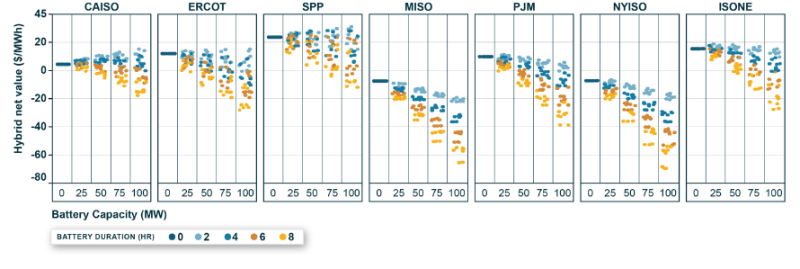

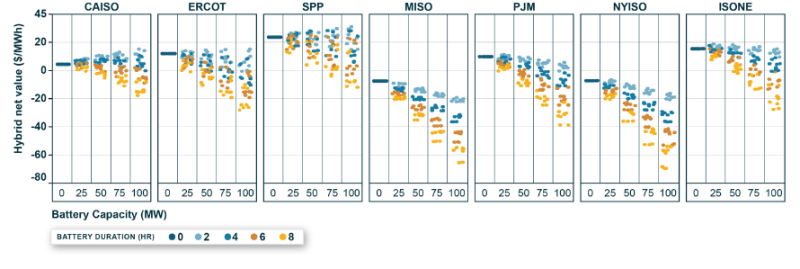

D. Configuration selection

(1) Market price encourages solar power generation facilities to deploy

short-term battery energy storage systems

We found significant differences in the final figures by configuration and

region, with solar generation penetration being a major factor.

(2) The duration and energy storage capacity of the battery energy storage

system have the greatest impact on the net value of the hybrid deployment

project

In the most attractive hybrid deployment project configuration to receive

the Federal Investment Tax Credit (ITC), the duration of the battery energy

storage system is often 2 to 4 hours, and the installed capacity of the

supporting battery energy storage system is a solar power installation or 25% or

100% of the installed capacity of the wind power facility, depending on the

region (shown below).

Setting grid interconnection capacity to allow both renewable generation

and energy storage to discharge simultaneously would yield a higher net hybrid

value than limiting the interconnection size to only solar or wind

installations.

(3) Among the areas served by CAISO, ERCOT and SPP, the net value of solar

+ energy storage projects with short duration is the highest

The duration of grid-connected projects and proposed deployments is

typically 1 to 4 hours. Among all battery storage systems, the relative value of

hybrid deployments is highest among the California Independent System Operator

(CAISO), Electric Reliability Commission of Texas (ERCOT), and Southwest Power

Associates (SPP) service areas, which have a large number of proposed Deployed

solar + energy storage projects. The study also found that the net worth of

solar-plus-storage projects is more attractive than wind-plus-storage projects

when the federal Investment Tax Credit (ITC) is included.

(4) The penetration rate of solar energy in the region promotes the value

of solar + energy storage projects

High solar penetration shifts the time of grid price peaks from summer

afternoons to evenings, enabling solar power utility projects to gain greater

value. California Independent System Operators (CAISOs) have had the greatest

impact so far, with solar penetration reaching 21% in 2020.

However, as energy storage systems improve the ability to transfer energy,

the deployment of solar power facilities projects that cut power generation to

change the timing of power generation has become redundant. In contrast,

configurations that maximize solar power generation (including through

single-axis tracking systems and scaling solar power facilities) can provide

greater net benefit when combined with energy storage.