Rising battery cell prices affect the energy storage market, what should we do?

GGII

data shows that in 2021, China's energy storage battery shipments will

increase by more than 270% year-on-year. The data is very encouraging

because it is being done at a time when the world is still suffering

from a global economic slowdown.

But

this has also brought another consequence. Since September last year,

the prices of upstream raw materials have been "singing forward", and

there are still acts of malicious roasting and hoarding in the market.

But even under such cost pressure, material suppliers are still in

short supply. Since the beginning of this year, lithium carbonate has

increased by about 78.57%, nickel has increased by about 45.16%;

cobalt has increased by 16.32%. To put it directly, the high price of

finished products has not made lithium-ion battery manufacturers more

profitable, and it is the mines and transporters who are making

substantial profits.

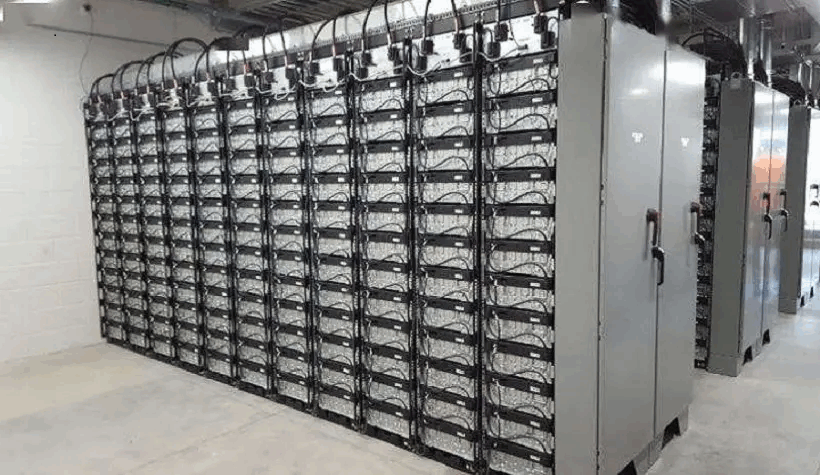

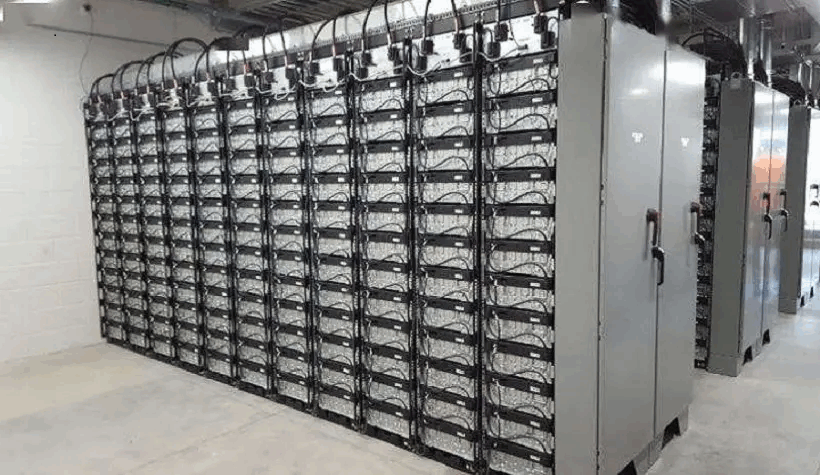

With SES Power's years of experience in

customizing lithium-ion battery systems, the lithium-ion energy

storage system is mainly composed of battery packs, energy storage

converters (PCS), battery management systems (BMS), energy management

systems (EMS) and other electrical equipment. Among them, the cost of

battery pack accounts for nearly 60%, PCS accounts for 10-20%, and

other costs account for about 20-30%.

Energy storage companies

generally believe that such increases will not last long, but this

situation does have a greater impact on the industry and increases

risks. The impact of this price increase on different companies is

also different. Everyone's attitude towards this market is very firm.

The most important thing at this stage is to eliminate the expectation

of price increases at the source even under the circumstances of a

lot of realistic pressure.

In our opinion, most companies will

make a relatively conservative decision at present. Enterprises with

relatively strong strength may digest the price increase of battery

cells when the project is confirmed. However, companies with

relatively weak capital chains cannot withstand the price pressure and

can only follow the price increase.

In this "price war",

stabilizing the market is like stabilizing the military's heart.

Leading enterprises and leading brands act as the true leader of an

industry when they can accommodate themselves, which is one of the most

important ways to stabilize the market.

It is worth noting

that under the current situation of global energy tension, the price

increase of lithium batteries does not really affect the demand, and

the global market is generally more accepting of price increases.

The

surge in lithium battery raw materials has put SES Power under

tremendous pressure. We use 12V100Ah, 12V200Ah, 24V100Ah, 24V200Ah,

36V100Ah, 48V50Ah, 48V100Ah, etc. 12V50Ah, 12V60Ah car starting

batteries (the maximum peak current can reach 1500A), almost need to

be costed once a week. In response to the upstream price increase, we

upgrade our products on the one hand, and strive to guide the market

with quality. On the other hand, look for better suppliers and

products, or use qualified echelon batteries while ensuring safety and

quality. We believe that with the gradual release of upstream

production capacity, material prices will enter a downward cycle from

the second half of the year to 2023.

This round of price

increases has a greater impact on large projects with long project

cycles. However, most practitioners face the market rationally and

calmly, and actively respond to them, gradually forcing enterprises to

deploy and think about multi-technology routes. For example, some

companies have accelerated the research and development of sodium

ions.

SES Power believes that the industrial system must

maintain a reasonable gross profit margin, pay attention to the

management system of the entire life cycle of the energy storage

system, and follow the inherent laws of the industrial economic system

to ensure the healthy development of the market. As the core cost

component of the lithium-ion energy storage system project, the

substantial price increase directly affects the project income. For

these projects, the result is nothing more than requiring developers,

integrators and battery manufacturers to make profits in varying

degrees to ensure the normal implementation of the project.