Two companies plan to purchase 50GWh of energy storage batteries from

Norwegian company FREYR

Tom Jensen, CEO of Norwegian lithium-ion battery start-up FREYR Battery,

said in an interview with industry media that the company's gigafactory could

use half of its 100GWh capacity target for energy storage systems by 2030, and

will also introduce system integration business.

Founded in 2018, FREYR plans to build four super plants in MoI Rana,

Norway, with a total annual capacity of 36GWh, which will be online from 2023 to

2025. But unlike other players in the battery industry, FREYR's battery products

are mainly supplied to the energy storage industry.

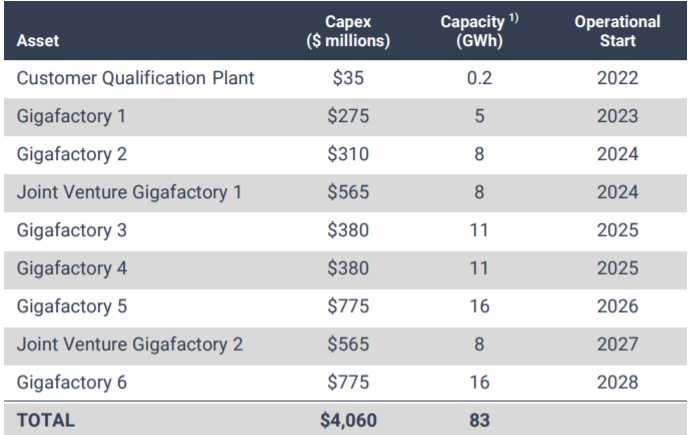

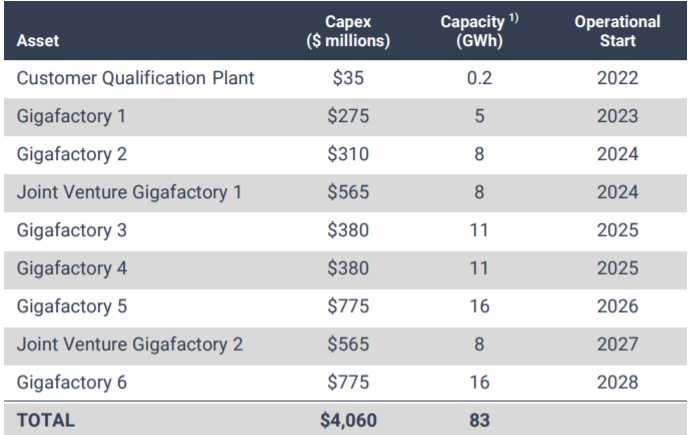

Jensen said, “Our goal is to have 83GWh of annual capacity by 2028 and over

100GWh by 2030, and based on where we are now, we think that half of the

batteries produced can be put into the energy storage market by 2030.” He

explained that FREYR The company's technology to manufacture batteries, licensed

from US-based battery producer 24M, is well suited for energy storage

applications and therefore targets all market segments of battery energy storage

systems.

Jensen said: “We believe that the battery storage market is growing much

faster and will be much larger than most people think. So, if we want to, we can

actually put all the capacity into the storage market. But we also have a lot of

interest in the mobile and electric vehicle markets, so the final percentage of

our capacity will depend on how the market develops.”

Honeywell will buy 19GWh batteries from FREYR between 2023 and 2030, while

another unnamed partner will buy 31GWh batteries over the same period, which

will allow FREYR to contribute to its systems integration business. The

importance of the energy storage market as the company's main market is clear

from this fact

“We want to form a joint venture with a partner to develop a containerized

energy storage solution, which includes other products such as a battery

management system (BMS),” Jensen said. “This will effectively be a system

integration approach to working with the partner.”

The gigafactory REYR plans to build in the next few years

Norway is one of the few countries to achieve its goal of 100% renewable

energy thanks to its abundance of hydroelectric power. Electricity for FREYR's

batteries will come almost entirely from renewable hydroelectric facilities, but

also some from wind, Jensen said.

Jensen also touched on three large discussion topics in the battery energy

storage space and in the wider battery ecosystem: Lithium Iron Phosphate (LFP)

vs. Nickel Manganese Cobalt Ternary Lithium (NMC) Pros and Cons Debate, Lithium

Battery Materials Supply Chain issues and battery sustainability, these are the

main principles followed by FREYR.

Lithium Iron Phosphate Battery (LFP) vs Nickel Manganese Cobalt Ternary

Lithium Battery (NMC)

Lithium Iron Phosphate (LFP) batteries will become increasingly It is

increasingly adopted by the battery energy storage industry.

“Our technology platform is flexible,” Jensen said. “Our first gigafactory

will meet customer demand to produce lithium iron phosphate (LFP) batteries,

which we are seeing increasing interest from many automotive stakeholders. The

more interested. Customers are also interested in the production of

nickel-manganese-cobalt ternary lithium batteries (NMC) we produce. But to the

extent we use cobalt, it will be done in a responsible and sustainable way

through our partnership with Glencore purchase."

He pointed out that compared with lithium iron phosphate (LFP) batteries,

lithium iron phosphate (LFP) batteries with lower energy density are not as

important in the energy storage environment of the number of charge and

discharge, and because of the ability to choose to produce larger batteries,

24M's technology also has advantages.

However, supply chain issues have caused the price of lithium iron

phosphate batteries to be temporarily flat or even lower than that of

nickel-manganese-cobalt ternary lithium batteries (NMC) for the first time.

"What we're seeing right now is a temporary bottleneck, and of course, it's

challenging in terms of near-term pricing, but we're having conversations with

our customers and working out business arrangements to deal with material price

increases," Jensen said. I think all battery manufacturers are facing the same

challenges. So relatively speaking, the price of battery products will become

more expensive, but the relative cost advantage of this technology is still the

same.”

SES Power agrees with Jensen's point of view that the battery energy

storage industry is now in the early stage of rapid growth, and the lithium

battery industry is also in a period of renewal, such as the latest subversive

all-solid-state lithium batteries, sodium-ion batteries, 4680 lithium batteries,

etc. The purpose of these new lithium battery technologies is almost always

based on safety and cost considerations. Also because the lithium battery energy

storage system, especially the lithium iron phosphate battery, has reached a

critical point of profitability, SES Power has launched 12V100Ah, 24V100Ah,

36V100Ah, 48V100Ah of square aluminum-shell lithium iron phosphate batteries

using EVE, CATL, and BYD, household energy storage 3KW, 5KW systems,

rack-mounted energy storage systems and other products.

Of course, we also see some requirements for lithium batteries that are

quite demanding in the environment. We also launch lithium iron phosphate

batteries that can be used normally under -40 degrees Celsius. This is very

suitable for some outdoor lithium battery energy storage projects.