Power Battery "Battle for Supremacy": Can CATL hold on to its throne in the

face of LG's attack

LG and CATL are both leaders in the lithium battery industry, and SES Power

has a long history of cooperation with them and has been paying considerable

attention to their development, as they have the world's top ternary lithium

batteries, lithium iron phosphate batteries, and even sodium ion batteries and

solid-state lithium batteries.

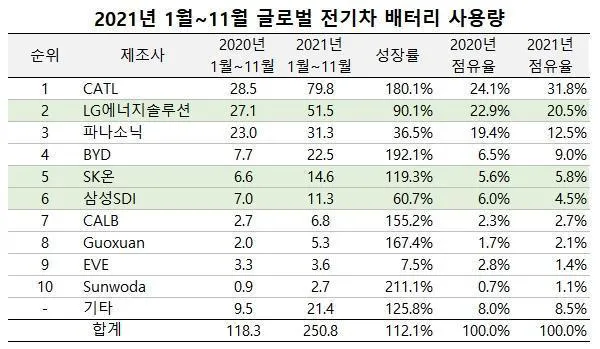

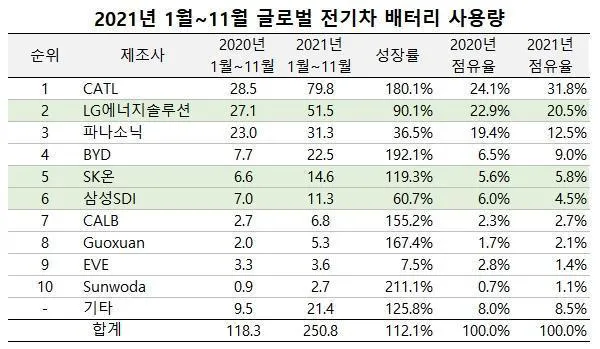

According to data released by SNE Research, a South Korean market research

firm, CATL maintained its dominant position in the electric vehicle battery

market from January to November 2021. CATL held the No. 1 position with a market

share of 31.8%, 10% points higher than second-place LG New Energy Solutions.

SNE Research noted that Chinese companies led the growth of the electric

vehicle battery market (including pure electric vehicles, plug-in hybrids and

hybrids) from January to November 2021. Compared to the same period 2020, CATL

and BYD grew by 180% and 192%, respectively.

A: CATL

When we talk about power batteries, we can definitely think of CATL. CATL

New Energy was established in 2011, which is born from ATL, the leading battery

manufacturer in the global consumer electronics neighborhood, and the personnel

technology is the same. Its main field of involvement is the research and

development, production and sales of new energy power batteries, and lithium

batteries have been its research direction, and in recent years, there are also

involved in the research of sodium ion batteries and so on.

In 2015, CATL carried out global layout through WIPO; in 2017, the use of

power battery systems developed and produced by the company climbed to the first

in the world and has been maintained since; in June 2018, the company

successfully landed on the A-share Growth Enterprise Board and listed on the

Shenzhen Stock Exchange; in 2019, the company began to increase the progress of

globalization.

CATL' suppliers are all leading domestic enterprises, and it cultivates its

own quasi-foundry through the method of equity participation, while

decentralizing suppliers to reduce costs while safeguarding production capacity.

In order to improve the match between end products and vehicles, CATL has

improved the performance of battery energy density, heat dissipation, shock

resistance, short circuit prevention, etc. Therefore, the battery system has the

largest proportion of patents. However, CATL has fewer patent applications in

the direction of battery materials, and it is more difficult to restrict

suppliers' offers through technical barriers.

B: LG New Energy

In 1995, LG Chem established the Battery Business Division and started

lithium secondary battery R&D. In 2011, the company officially entered the

power battery industry; in 2020, an independent subsidiary LG Energy Solutions

was established, and the new company will accelerate the development of

new-generation battery technologies such as all-solid-state batteries and

lithium-sulfur batteries, with products covering power batteries, energy storage

and consumer batteries. To date, it has received 180 trillion won worth of

electric vehicle battery orders from global automakers.

In terms of market layout, LG New Energy currently has global production

and operation systems and technology innovation centers in China, Korea, the

U.S. and Europe. LG New Energy's partners are currently focused on mainstream

vehicle brands, with 13 of the world's top 20 automotive brands as its

partners.

In terms of technology, LG New Energy was the first company in the world to

mass-produce ternary cathode materials, and was the first in the industry to

mass-produce the nickel-lower cobalt quaternary lithium battery (NCMA) in 2021.

It is worth mentioning that the quaternary lithium battery is considered by the

industry to be a better solution to the balance of power battery in terms of

range, cost, fast charging and safety, and is expected to make up for the

shortage of ternary batteries in terms of cost and safety.

In terms of safety, LG New Energy has mastered the core key material

technology such as diaphragm, developed intelligent BMS with artificial

intelligence and deep learning technology, realized the transmission of big data

and safety diagnosis algorithm results through OTA, and optimized the safety and

accurate monitoring and early warning of the battery in real time. At the same

time the application of the latest safety technology module and CTP highly

integrated design, significantly improve the safety and reliability of the power

battery.

For future target planning, LG New Energy plans to achieve a 260GWh

capacity breakthrough by 2023; achieve $270 billion in sales by 2024 and become

the number one company in the electric vehicle power battery field;

commercialize lithium-sulfur batteries by the end of 2025; and commercialize

all-solid-state batteries between 2025 and 2027.

C: CATL VS LG New Energy

The explosion of electric vehicles, large energy storage systems,

photovoltaic energy storage and other industries has directly driven the demand

for lithium batteries to blow up. According to the forecast of EV Volumes, a

famous consulting company in Sweden, by 2025, the global power battery demand

will exceed 1000GWh and enter the TWh era; while the data of SNE Research in

South Korea shows that the installed capacity of power batteries in electric

vehicles will reach 1163GWh in 2025 and 2963GWh in 2030, with a big increase in

power battery demand.

Why would LG be said to be the biggest rival of CATL and not other

companies? On the one hand, it is because of the production volume, and on the

other hand, it is because of their cooperative manufacturers.

Lithium battery expansion is a cycle, investment in site selection,

construction of production lines, capacity climbing and a series of need to

layout in advance. A very important aspect of the constraint production is raw

materials: the two leading companies have successively laid out a large upstream

industry, hoping to open up the industrial chain, through its own resources to

further ensure the release of production and enhance the right to speak.

But the power manufacturers are not only the production line, how much can

be installed is the decisive factor. From the current manufacturers have been

bound to support the new energy vehicle enterprises, LG new energy is indeed the

most opportunity to catch up with the existence of CATL.

From the perspective of the entire power battery industry, the current

global market is basically guided by Chinese, Japanese and Korean enterprises.

LG New Energy and CATL are the only two companies that are half of the world,

and the double oligarchy pattern is gradually forming. In this case, European

and American companies want to break through, either cross-generational research

and development of new technologies, or make huge investments to participate in

the cost war.

Performance comparison: In 2018-2020, LG New Energy and CATL's lithium

battery business revenue are steadily increasing, and in 2020, LG Chem's lithium

battery business revenue will be $11.4 billion and total revenue will be $26.7

billion; CATL's lithium battery business revenue will be $6.4 billion and total

revenue will be $7.8 billion.

Market share comparison: According to the installed volume data of power

lithium batteries, in 2019-2021, LG New Energy's market share rose more rapidly,

up nearly 12 percentage points in one and a half years, but CATL's market share

fell by 2.44 percentage points.

Capacity comparison: In 2020, LG New Energy's lithium battery capacity is

120Gwh, CATL' lithium battery capacity is 69.1Gwh, LG New Energy's capacity is

nearly 2 times that of CATL. According to LG New Energy's medium-term plan, in

the future, the company's lithium battery capacity will reach 260 Gwh. According

to the company's announcement, CATL has disclosed that its lithium battery

capacity under construction is 77.5 Gwh, and after the completion of the

capacity, the future capacity of CATL will reach at least 146.6 Gwh.

Overall, CATL is in a slight lead over LG Chem, but LG Chem's faster growth

rate will make CATL' position challenged.

SES Power believes that the application market and environment of power

battery products lead to extremely strict requirements for product performance

and quality from end customers, and only by continuously investing in R&D

for technological innovation, process and material improvement can we continue

to meet the requirements of competitive market development. Although on the

surface, the power battery is grabbing the market, in fact, the competition

behind is technology, and the investment in research and development can be

imagined.