Energy storage manufacturer Stem recently released a survey report that pointed out that the company's revenue in the third quarter of this year increased by 334% year-on-year. This is the first quarter that Stem has a positive gross profit margin in its history.

Stem’s revenue for the third quarter of 2021 reached 39.8 million U.S. dollars, the highest quarterly revenue so far, far higher than the 9.2 million U.S. dollars reported in the third quarter of 2020.

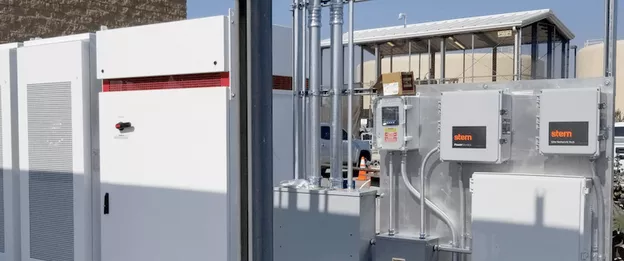

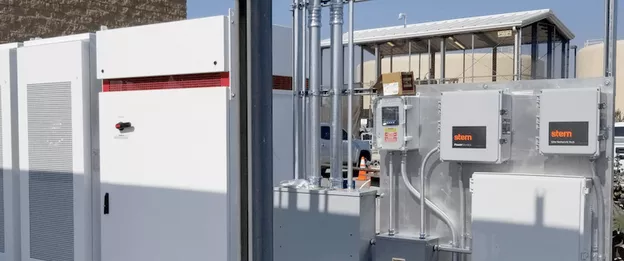

The company is mainly active in the field of commercial and industrial (C&I) user-side energy storage. It usually deploys battery energy storage systems for them after signing contracts with customers, and at the same time integrates its energy storage systems into grid services to help them reduce peak electricity consumption and reduce costs.

Stem reaffirmed its goal of reaching US$147 million in revenue for the full year 2021. As of the end of the third quarter, the company's backlog of contracts reached 312 million US dollars, an increase of 25% compared with the previous quarter.

Stem CEO John Carrington pointed out that the second half of each year (especially the fourth quarter) is often the busiest period for the company's business. Revenue in the fourth quarter of 2021 may account for 50% to 60% of full-year revenue.

However, achieving and maintaining long-term profitability is still a huge challenge. Stem’s earnings showed a reduction in losses in the quarter, and its EBITDA loss was $7.2 million instead of the second quarter of 2021. Recorded 8.5 million US dollars. Earnings before interest, taxes, depreciation and amortization (EBITDA) for 2021 is $25 million. Before Stem was listed on the New York Stock Exchange, it was expected that long-term profitability would not be realized until 2023 at the earliest.

Despite the difficulties, Stem executives said they are confident of expanding scale and increasing gross profit margins to meet expected demand growth. John Carrington pointed out that as of the end of September this year, the company's 12-month forward loans totaled US$2.4 billion, an increase of 41% from the end of June (US$1.7 billion). Stem also manages 1.4GWh of assets (AUM).

Bill Bush, the company's chief financial officer, pointed out that the company's hardware gross profit margin is between 10% and 30%, while the software gross profit margin is above 80%. Bush said that maintaining a light asset strategy can keep Stem’s spending at a low level. The supply chain has now become a key issue in 2021, which is already obvious in the solar power industry. Recently, there have been reports that battery energy storage manufacturers have also begun to encounter supply chain constraints.

Carrington said, “Stem has ensured that its supply chain will not be affected by the third quarter of 2022. I am very satisfied with our relationship with suppliers.” The company currently purchases products from three core suppliers and hopes to increase its supply chain. Four suppliers. Carrington said: "The diversity of suppliers is very important and is an important part of ensuring that we deliver energy storage products to our customers."

Some of the company's project delays are directly related to the new crown epidemic, staffing issues, affecting interconnection and licensing processes. He said that Stem will work directly with utility companies and allow relevant agencies to reduce delays. Carrington pointed out that the company's grid-side energy storage system reservations accounted for 80% in the third quarter of 2021, many of which came from Texas customers. About 75% of the energy storage systems deployed in the future will be grid-side energy storage systems. The company expects that demand in major markets will accelerate growth, including California, Texas, Arizona, and the northeastern United States.

Lithium-ion battery (LIB) has become the main energy storage solution in modern social life. Among them, lithium iron phosphate battery is a perfect replacement for lead-acid batteries, and it is the first choice for grid-connected peak shaving, off-grid energy storage, photovoltaic energy storage, UPS, data center and other industries.

Solar power generation system with lithium battery energy storage system is a very promising clean energy.